Financial Planning for Taxes: Saving Smartly Throughout the Year

Are you stressed every tax season because you’re scraping together cash to pay your taxes? A staggering 60% of Americans are not prepared for unexpected expenses like a hefty tax bill.

This blog post is here to overturn that trend, outlining smart financial habits to help create a stress-free tax season. Ready to transform how you manage money? Let’s dive in!

Key Takeaways

- Financial wellness involves understanding and managing your finances to meet your goals without stress.

- Creating a budget is crucial for financial wellness, as it helps track expenses, reduce debt, and save for emergencies and taxes.

- Planning for taxes throughout the year can minimize stress by establishing habits such as saving a portion of each paycheck and keeping track of potential deductions.

- Smart financial habits include saving for emergencies, reducing debt, automating savings, investing in retirement, utilizing financial education and tools, increasing earning power, and maintaining consistency in budgeting.

Understanding Financial Wellness and Planning for Taxes

Financial wellness involves having a comprehensive understanding of your financial situation and making proactive plans, including budgeting and tax planning.

Define financial wellness

Financial wellness goes beyond having money in the bank. It envisions a lifestyle where you can manage your expenses, meet your financial goals, and secure your future without undue stress.

This involves creating a budget that caters to both personal needs and wants, while ensuring that savings are put aside for emergencies or unexpected events. Committing to this practice fosters an environment of growth, allowing individuals to reduce debts efficiently, save consistently and plan better for their retirement years.

In essence, financial wellness is achieved when you have control over day-to-day finances with the ability to withstand economic shocks and maintain financial discipline all year round.

Importance of having a budget

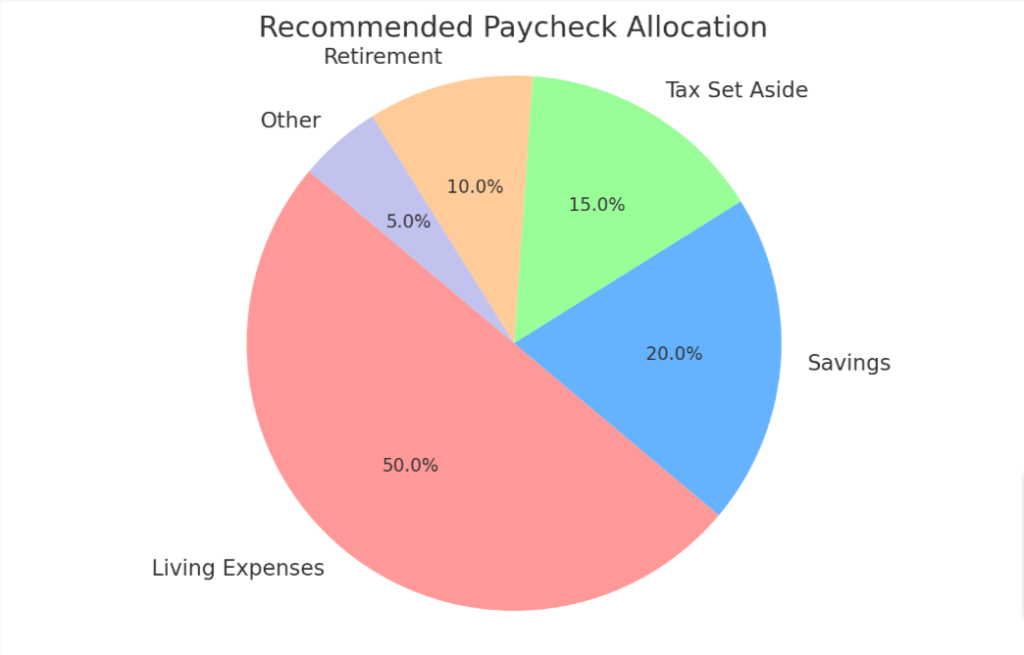

A budget plays a crucial role in maintaining financial wellness. It serves as a roadmap to guide your spending and saving choices, from major purchases to daily expenses. With a realistic and well-planned budget, you can effectively manage income allocation and keep track of where every dollar goes.

This financial discipline helps prevent impulsive buying, encourages debt reduction, and fosters savings for emergencies or retirement contributions. Moreover, it aids in setting aside money for taxes, reducing the likelihood of unexpected tax liabilities that could disrupt your financial stability.

A robust budgeting strategy ultimately promotes better money habits and paves the way to long-term financial security.

Planning for taxes throughout the year

Planning your taxes throughout the year reduces stress and increases financial well-being. Here are some strategies to consider:

- Establish a savings habit: Aim to set aside a portion of each paycheck for taxes. This helps ease the burden when tax season arrives.

- Analyze your tax withholding: Review your W4 form annually to make sure you’re not overpaying or underpaying taxes.

- Keep track of potential tax deductions: Expenses like school supplies, business trips, and home office costs can often be deducted.

- Use a budgeting tool: A good financial management app can help you stay organized and on track with your saving goals.

- Consult with a tax professional: Even if you file your own taxes, it’s beneficial to periodically check in with an expert for advice.

- Save for emergencies: An emergency fund provides a safety net for unexpected expenses or sudden income loss, and this includes unexpected tax bills.

- Invest in retirement contributions: Certain retirement plans offer tax advantages that not only benefit you now but also in the future.

- Practice financial discipline: Be mindful of unnecessary spending that could be saved for tax payments instead.

Smart Financial Habits for Tax Planning

Saving for emergencies is a crucial part of smart financial habits for tax planning.

Saving for emergencies

Building an emergency fund is a crucial part of smart financial habits for tax planning. By setting aside money specifically for unexpected expenses, you can avoid dipping into your savings or going into debt when unforeseen circumstances arise.

Whether it’s a sudden medical expense, car repair, or job loss, having an emergency fund gives you peace of mind and financial security. Make it a priority to save a portion of your income each month towards building this fund.

Start small if necessary and gradually increase the amount over time. Having three to six months’ worth of living expenses saved up is typically recommended.

Reducing debt

Reducing debt is a crucial step in achieving financial wellness and planning for taxes. By minimizing the amount of money you owe, you can free up more funds to allocate towards your tax obligations and other important financial goals.

One effective way to reduce debt is by creating a realistic budget that includes debt repayment as a priority. This will help you track your expenses, identify areas where you can cut back, and allocate more money towards paying off your debts each month.

Additionally, consider exploring strategies such as consolidating high-interest debts or negotiating lower interest rates with creditors to accelerate the repayment process. Taking proactive steps to reduce debt will not only improve your overall financial stability but also ensure that you have more resources available when it comes time to file your taxes.

Another way to manage debt effectively is by automating payments wherever possible. Set up automatic transfers from your bank account to pay down loans or credit card balances on time each month.

Automating savings

Automating savings is a smart financial habit that can help individuals consistently set aside money for various goals, including taxes. By setting up automatic transfers from your checking account to a designated savings or investment account, you eliminate the risk of forgetting or spending the money intended for saving.

This way, you are more likely to consistently save and build up your funds over time. Automating savings also allows you to allocate a specific percentage or amount of each paycheck towards your savings goals without much effort, ensuring that your tax funds are well-managed throughout the year.

Investing in retirement

Investing in retirement is a smart financial habit that can help ensure a comfortable future. By setting aside money for retirement, you are taking proactive steps to secure your financial wellbeing in the long run.

Consider contributing to retirement accounts such as 401(k)s or IRAs on a regular basis to take advantage of potential tax advantages and compound interest. It’s important to start early and consistently contribute to these accounts, even if it’s just a small amount each month.

By investing in retirement now, you’ll be better positioned to enjoy your golden years without financial stress later on.

Tips for Practicing Healthy Money Habits

Utilize financial education and tools, increase your earning power, and be consistent in your budgeting to establish healthy money habits.

Utilizing financial education and tools

Financial education and tools can greatly assist in developing smart financial habits for tax planning. Here are some ways you can make use of them:

- Take advantage of online resources: Use websites, blogs, and forums to gain knowledge about financial management, budgeting tips, and tax planning strategies.

- Attend financial workshops or webinars: Participate in seminars or webinars that focus on financial topics such as budgeting, saving for emergencies, and maximizing tax deductions.

- Use budgeting apps: Download mobile applications that help track your expenses, set savings goals, and keep your finances organized.

- Seek advice from a financial advisor: Consult with a professional who can provide personalized guidance on tax planning strategies based on your specific financial situation.

- Utilize tax software: Invest in reliable tax preparation software to streamline the process of organizing your financial information and ensuring accurate tax calculations.

- Subscribe to financial newsletters: Stay updated on the latest trends in personal finance by subscribing to newsletters that deliver relevant information straight to your inbox.

- Join online communities: Engage with like-minded individuals through online communities dedicated to personal finance discussions. Exchange tips, ask questions, and learn from others’ experiences.

Increasing earning power

Increasing earning power is a crucial aspect of smart financial habits for tax planning. By finding ways to boost your income, you can not only have more funds available for taxes but also improve your overall financial health.

One way to increase earning power is by seeking opportunities for career advancement or professional development. Consider taking on additional responsibilities at work or acquiring new skills that make you more valuable in the job market.

Another option is to explore side hustles or freelance work that can bring in extra income. By actively working towards increasing your earnings, you’ll have more financial flexibility and be better prepared when it comes time to pay taxes.

Consistency in budgeting

Consistency in budgeting is a crucial habit for effective financial management. By consistently tracking and monitoring your expenses, you gain a clear understanding of where your money goes and can make informed decisions about spending.

This allows you to identify areas where you can cut back or save, ultimately helping you achieve your financial goals. Consistency also helps establish discipline and accountability, making it easier to resist impulsive purchases and stick to your budget over time.

With consistent budgeting, you can build good money habits and maintain control of your finances for long-term success.

Conclusion

In conclusion, implementing smart financial habits for tax planning is crucial for maintaining financial wellness. By budgeting consistently, saving for emergencies, reducing debt, and investing in retirement, individuals can set themselves up for success when it comes to managing their taxes.

By utilizing financial education and tools, increasing earning power, and practicing consistency in budgeting, anyone can establish healthy money habits that benefit them both now and in the future.

Start taking control of your finances today by setting aside money for taxes and making smarter financial decisions overall.

Recap of key points

To recap, setting aside money for taxes is a smart financial habit that can contribute to your overall financial wellness. It involves understanding the importance of budgeting and planning for taxes throughout the year.

By saving for emergencies, reducing debt, automating savings, and investing in retirement, you can practice healthy money habits that will benefit you in the long run. Utilizing financial education and tools, increasing earning power, and maintaining consistency in budgeting are additional tips to help you succeed.

Start implementing these strategies today to take control of your finances and ensure tax preparation becomes a seamless part of your financial organization.

Encouragement to begin implementing smart financial habits for tax planning.

Start taking control of your finances by implementing smart financial habits for tax planning. It’s never too late to start saving for emergencies, reducing debt, automating your savings, and investing in retirement.

By practicing healthy money habits like utilizing financial education and tools, increasing your earning power, and consistently budgeting, you can achieve financial wellness. Take the first step towards a more secure future by setting aside money for taxes and establishing good money management practices today.