Securing Your Financial Future: The Importance of an Emergency Fund

Financial stability can often be a challenge for freelance writers. Surprisingly, nearly 60% of freelancers have no financial cushion to fall back on in case of emergencies. This blog post aims to guide you through the process of building an emergency fund that ensures your financial security during unforeseen circumstances or income uncertainties.

Ready? Let’s dive into money management made simple!

Key Takeaways

- An emergency fund is crucial for freelance writers as it provides financial stability and helps manage unexpected expenses without resorting to credit card debt.

- Calculate your emergency fund needs by listing monthly expenses, including unforeseen costs, and aim to save at least three to six months’ worth of living expenses.

- Set a monthly savings goal, utilize unexpected income, and increase your income through freelance gigs or side jobs to build your emergency fund.

- Having an emergency fund provides financial stability, peace of mind, flexibility in handling unplanned circumstances, reduced stress, the freedom to take risks, the ability to avoid debt accumulation during emergencies or slow periods, and potential growth over time.

What is an Emergency Fund?

An emergency fund is a cash reserve set aside to cover unexpected expenses or financial emergencies. It is crucial for freelance writers to have an emergency fund as it provides financial stability and helps them manage unplanned expenses without resorting to credit card debt.

Calculating your emergency fund needs involves determining your monthly expenses and setting aside enough money to cover several months’ worth of living costs in case of job loss or medical bills.

Definition

An emergency fund refers to money set aside specifically to cover unexpected expenses that may arise in times of financial distress. Often, it acts as a financial safety net when confronted with unplanned instances such as job loss, medical emergencies or significant repair bills.

For freelance writers who don’t have the security of persistent income like their salaried counterparts, an emergency fund becomes even more critical for maintaining economic stability and resilience.

Importance for Freelance Writers

Freelance writers often face unpredictable income due to the nature of their work, making an emergency fund critically essential for financial stability. Building this fund ensures they can handle unplanned expenses, such as job loss or hefty medical bills, without accruing credit card debt.

A solid cash reserve also provides financial security during periods of low commissions or late payments from clients. Therefore, possessing a rainy day fund aids in better money management and reduces the risk of financial emergencies in the freelance writing profession.

Calculating Your Emergency Fund Needs

Calculating your emergency fund needs is a significant step towards financial stability.

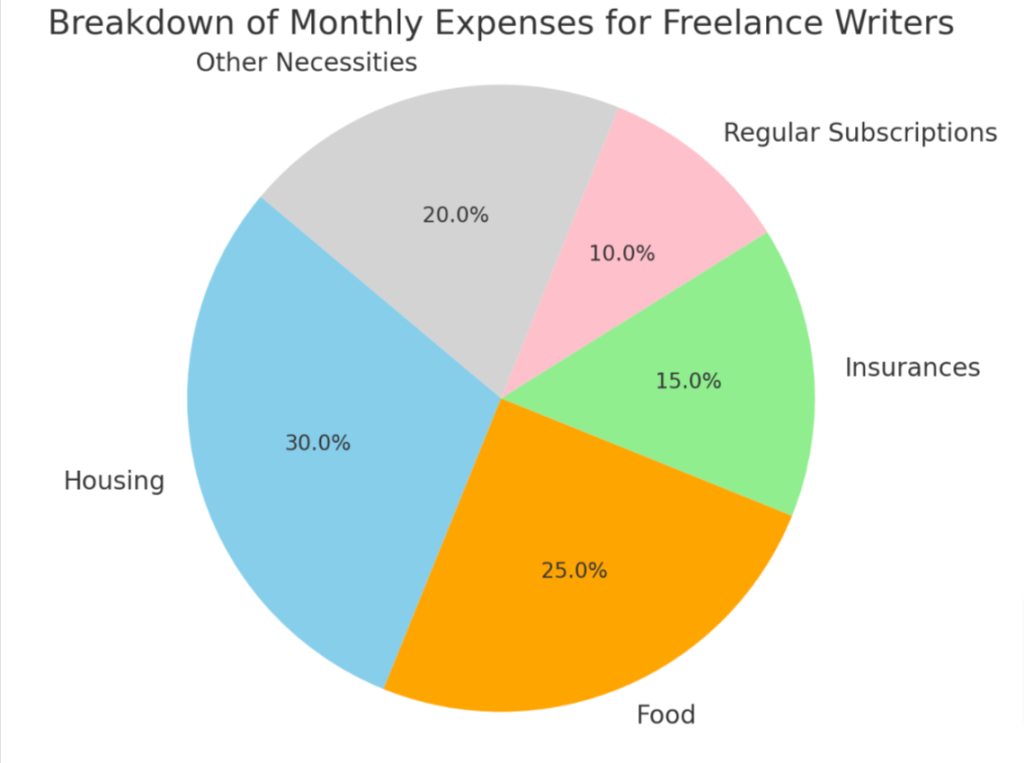

- First, list all your monthly expenses. Include everything from housing and food to insurances and regular subscriptions.

- Next, tally up any predictable costs that might arise over the year like annual subscriptions or holiday spending.

- Don’t forget to account for unforeseen expenses as well. This could be anything from unexpected car repairs to medical bills.

- Once you have a clear number for your total yearly expenditure, divide it by 12. This gives you an average monthly expense figure.

- Aim for an emergency fund that’s able to cover at least three to six months worth of these expenditures.

- As a freelance writer with fluctuating income, consider saving enough money to cover even up to six months of expenses in your emergency fund.

Strategies for Building an Emergency Fund

– Set a Monthly Savings Goal: Determine how much you can realistically save each month and set that as your savings goal. This will help you stay focused and motivated to build your emergency fund.

– Utilize Unexpected Income: Whenever you receive unexpected income, such as a bonus or tax refund, put it directly into your emergency fund instead of spending it on nonessential items.

– Increase Your Income: Look for ways to increase your income through freelance gigs or side jobs. Every extra dollar you earn can contribute towards building your emergency fund.

Set a Monthly Savings Goal

Setting a monthly savings goal is a crucial step in building an emergency fund. By determining how much you want to save each month, you can make progress towards your financial safety net.

Start by calculating your total expenses for the month, including bills, groceries, and other necessities. Then, set a realistic savings target based on your income and current financial situation.

By consistently saving this amount each month, you’ll be well on your way to creating a cash reserve that can provide peace of mind during unexpected emergencies or financial hardships.

Utilize Unexpected Income

To build an emergency fund as a freelance writer, it’s essential to utilize unexpected income that comes your way. Whether it’s a bonus from a client or payment for an extra gig, these windfalls can give your savings a significant boost.

Instead of immediately spending or splurging the money, allocate it towards your emergency fund. By doing so, you’re taking advantage of additional funds to secure your financial stability in case of unforeseen expenses or emergencies.

Remember that even small amounts can add up over time when consistently saved and properly managed.

Make it a habit to set aside any unexpected income directly into your emergency fund. This proactive approach enhances your financial security by gradually building up an ample cash reserve over time.

Plus, by treating unexpected income as an opportunity rather than a windfall, you’ll be better equipped to handle financial crises and avoid resorting to credit card debt or loans during emergencies.

Increase Your Income

To build and strengthen your emergency fund, consider finding ways to increase your income. As a freelance writer, there are various opportunities available for you to explore. You can take on additional writing projects or seek out higher-paying clients.

Another option is diversifying your skills by learning new writing styles or niches that may attract more lucrative assignments. Additionally, you could look for part-time work or side gigs that align with your interests and schedule.

By increasing your income, you’ll have more funds to contribute towards your emergency savings and achieve greater financial security in the long run.

Using Your Emergency Fund

Utilize the personal experiences and benefits for freelance writers to learn how to effectively use your emergency fund. Read on to discover more ways to safeguard your financial stability.

Personal Experiences

Many freelance writers have shared personal experiences highlighting the importance of having an emergency fund. They have expressed how this financial safety net has come to their rescue during times of crisis, such as job loss or unexpected medical bills.

Having a rainy day fund has provided them with peace of mind and allowed them to navigate through unforeseen expenses without going into credit card debt. These personal stories serve as a reminder that building an emergency fund is essential for financial stability and can be a lifesaver in times of need.

Benefits for Freelance Writers

Freelance writers can greatly benefit from having an emergency fund. Here are some advantages:

- Financial Stability: An emergency fund provides a safety net, ensuring freelancers can cover unexpected expenses and maintain financial stability.

- Peace of Mind: Having a cushion of savings allows freelance writers to worry less about financial emergencies and focus on their work.

- Flexibility: With an emergency fund, freelance writers can handle unforeseen circumstances like job loss or medical bills without relying solely on credit cards or loans.

- Reduced Stress: Knowing that there is a cash reserve available for emergencies alleviates the stress that comes with unexpected financial challenges.

- Freedom to Take Risks: With an emergency fund in place, freelance writers have the freedom to take on new projects or pursue entrepreneurial opportunities without fear of immediate financial consequences.

- Avoiding Debt: Having an emergency fund can help freelancers avoid accumulating credit card debt during times of crisis or unplanned expenses.

- Ability to Weather Slow Periods: Freelance writing income can fluctuate, but with a well-funded emergency account, writers can navigate through leaner periods more comfortably.

- Emergency Fund Growth: By consistently contributing to an emergency fund, freelance writers can experience the benefits of compound growth over time, which further boosts their financial security.

Tips for Building an Emergency Fund

- Organize your budget for better financial management.

- Cut costs to increase your saving potential.

- Automate your savings to make it easier and consistent.

- Track your progress regularly to stay motivated.

- Consider opening a high yield savings account for better returns

Read on to discover how these tips can help you build a solid financial cushion as a writer.

Organize Your Budget

Organize your budget to effectively build your emergency fund. Start by creating a detailed list of your monthly expenses. Next, categorize your expenses into essential and non-essential items.

Analyze where you can cut costs and reduce unnecessary spending. Consider using budgeting tools or apps to track your income and expenses. Set clear financial goals and allocate a specific amount each month towards your emergency fund. Stay consistent with your budgeting efforts to ensure steady progress in building your financial safety net.

Cut Costs

Cutting costs is an essential strategy to build your emergency fund. Here are some practical ways you can reduce your expenses and increase your savings:

- Evaluate your monthly bills and subscriptions. Cancel or downgrade any services that you don’t use frequently or can live without.

- Cook meals at home instead of eating out regularly. Not only will this save you money, but it’s also healthier.

- Comparison shop for groceries and household items to find the best deals and discounts.

- Use public transportation or carpool whenever possible to save on transportation costs.

- Reduce energy consumption by turning off lights when not in use, unplugging electronics, and adjusting thermostats.

- Consider cutting back on non – essential expenses like entertainment, shopping, or vacations until you have built up your emergency fund.

- Look for cheaper alternatives for necessary purchases, such as buying generic brands or purchasing items second-hand.

- Avoid unnecessary bank fees by being mindful of ATM usage and maintaining a minimum balance in your checking account.

Make Things Automatic

To make building an emergency fund easier, one strategy you can use is to make things automatic. Set up automatic transfers from your checking account to a separate savings account specifically dedicated to your emergency fund.

This way, a portion of your income will be automatically saved each month without you having to think about it or remember to do it manually. By automating this process, you eliminate the temptation to spend that money elsewhere and ensure consistent contributions towards your financial safety net.

It’s a simple step that can help you reach your savings goals faster and provide peace of mind during unexpected financial emergencies.

Track Your Progress

Track your progress by regularly monitoring the growth of your emergency fund. Keep a close eye on how much you’re saving each month and compare it to your savings goal. Use online tools or apps to help you track your progress easily.

Seeing the numbers increase will motivate you to stay disciplined with your savings plan. Additionally, consider creating a visual representation of your progress, such as a chart or graph, which can serve as a reminder of how far you’ve come.

By actively tracking your progress, you’ll be able to adjust your savings strategies if necessary and ensure that you’re on track towards building a solid financial safety net.

Consider High Yield Savings Accounts

High Yield Savings Accounts are a great option to consider when building an emergency fund. These accounts offer a higher interest rate compared to traditional savings accounts, allowing your money to grow faster over time.

By choosing a high yield savings account, you can maximize your savings potential and increase the amount of money available in case of unexpected emergencies or expenses. It’s a smart move for freelancers looking to build financial stability and create a solid safety net for themselves.

Conclusion

In conclusion, building an emergency fund is crucial for freelance writers to achieve financial stability. By setting a monthly savings goal, utilizing unexpected income, and increasing their income, writers can establish a cash reserve to handle unplanned expenses and protect themselves in times of crisis.

With smart money management techniques like budgeting and automatic savings, writers can create a solid financial safety net that will provide peace of mind and help them navigate any unexpected emergencies that may arise.