Evaluating Tax Advisors: Is Professional Help Right for You?

Navigating the maze of tax laws and regulations can be daunting, leaving you both stressed and confused. Did you know that a tax advisor could potentially save you thousands of dollars by finding deductions or credits you might have overlooked? This article is designed to guide you through the pros and cons of hiring a tax professional, from potential cost savings to possible drawbacks.

Ready to de-stress your taxes? Let’s dive in!

Key Takeaways

- Hiring a tax advisor can save you time and reduce stress by handling all aspects of tax preparation and optimizing your returns.

- Tax advisors are knowledgeable about complex tax laws, helping you identify potential savings and deductions that you may have overlooked.

- A tax advisor is essential in certain situations such as owning a business, having high – income earnings, or dealing with real estate investments to ensure compliance with specific regulations.

Why Work With a Tax Advisor?

Working with a tax advisor offers numerous benefits and can be necessary in certain situations.

Benefits of hiring a tax advisor

Hiring a tax advisor comes with several benefits.

- Tailoring personalized tax strategies is a forte of experienced tax advisors.

- They manage and optimize all aspects of tax-related issues, leaving you stress-free.

- A certified public accountant (CPA) ensures more comprehensive and accurate tax returns are filed on your behalf.

- You save precious time as they handle every bit of your tax preparation process.

- Excellent knowledge about tax laws helps them identify potential savings and deductions.

- Their expert advice is essential in understanding the complex financial goals you might have.

- In case of possible audits, they provide much – needed support.

- They can offer guidance on the tax implications of life events such as inheritance or gifts.

Situations where a tax advisor may be necessary

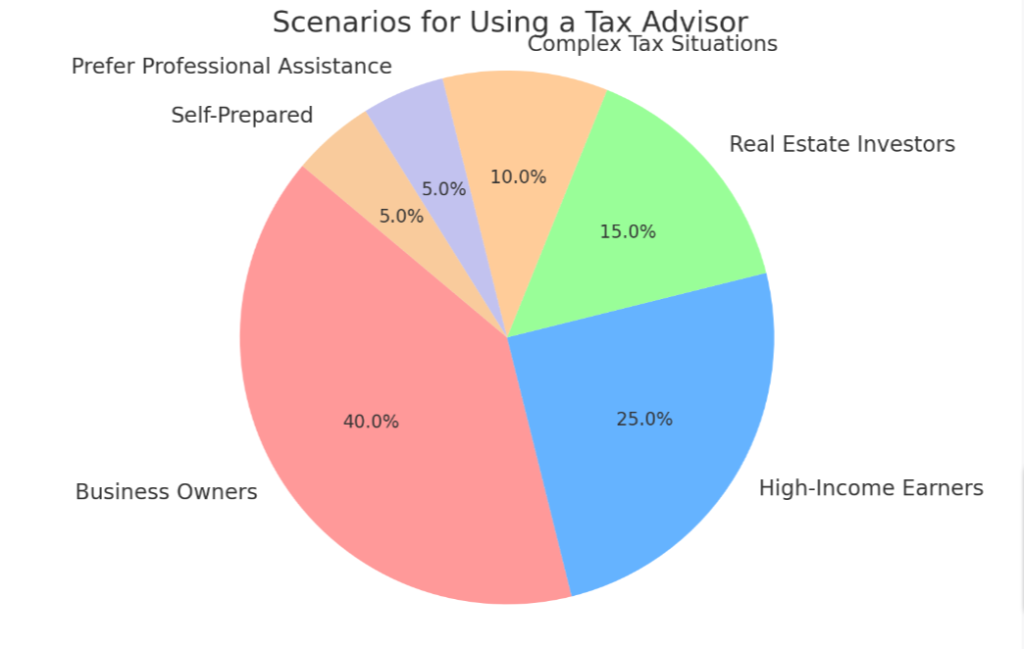

Navigating the financial world can become complex; many situations call for the expertise of a tax advisor. Here are some scenarios:

- You own a business: Tax laws for businesses differ greatly from individual tax laws. A tax expert is useful to help you understand these regulations.

- High-income bracket: The more money you earn, the more complicated your taxes may become. This is when tax planning could be necessary to ensure compliance and optimize savings.

- Real estate investments: Properties come with their own unique set of tax implications that a qualified advisor can guide you through.

- Overseas income: If you have income from other countries, figuring out how to report it correctly can get tricky without professional help.

- Inheritance or gift money: With large sums of money given away or inherited, a tax consultant can explain the potential consequences in straightforward terms.

- Frequent trading of stocks/bonds: Rapid buying and selling increase complexity in taxation, wherein a certified public accountant may provide much-needed clarity.

- Starting retirement planning: Orchestrating an efficient retirement strategy often involves understanding many intricate financial details where an advisor can come handy.

Reasons You Might Want to Hire a Tax Professional

Lack of knowledge about tax laws, complexity of tax situations, time constraints, potential for tax savings, and avoiding mistakes and penalties are all reasons why you might want to hire a tax professional.

Lack of knowledge about tax laws

Tax laws are vast and complex, often causing confusion for many individuals. This unified system of regulations determines how much money you owe the government, and understanding these intricate rules can pose a daunting task.

Without proper knowledge of tax laws, you risk making errors on your tax returns or missing out on potential deductions that could save you money. All too often, people overpay or underpay their taxes due to lack of expertise in this area.

Trusting a professional with advanced training in tax laws eliminates these risks as they keep up-to-date with constantly changing legislations to ensure accuracy on your filings.

Complexity of tax situation

Navigating the complexity of your tax situation can be overwhelming and time-consuming. From understanding new tax laws to figuring out deductions and credits, there are numerous factors that can make the process confusing.

Hiring a tax advisor who is well-versed in these complexities can help ensure that you file accurate returns and maximize your savings. They have the knowledge and expertise to delve into intricate tax issues, such as investments or inheritance, so you don’t miss any potential deductions or face penalties for mistakes.

By entrusting your taxes to a professional, you can feel confident that they will manage and optimize your tax situation effectively.

Time constraints

Managing your own taxes can be a time-consuming task, especially if you have a complex financial situation. With work, family, and other responsibilities taking up most of your day, finding the time to stay updated on tax laws and complete all the necessary paperwork can be challenging.

This is where a tax advisor can come in handy. By hiring a tax professional, you can free up valuable time that could be better spent focusing on your career or personal life. With their expertise and knowledge of tax regulations, they can efficiently prepare your taxes while ensuring compliance with all relevant laws.

In addition to saving time on tax preparation, working with a tax advisor also helps you manage and optimize any potential tax issues that may arise. They will analyze your financial situation and devise effective strategies to reduce your overall taxable income through deductions and credits.

By staying informed about changes in the tax code and implementing appropriate planning techniques, they can help you maximize your savings while minimizing any potential liabilities.

Potential for tax savings

A tax advisor can help you identify potential opportunities for tax savings. By analyzing your financial situation and understanding the intricacies of tax laws, they can find deductions, credits, and other strategies to minimize your tax liability.

With their expertise, they can ensure that you are taking advantage of all available benefits and incentives that may apply to your specific circumstances. By working with a knowledgeable professional, you have a better chance of maximizing your tax savings and keeping more money in your pocket.

Avoiding mistakes and penalties

Hiring a tax advisor can help you avoid costly mistakes and penalties. Tax laws are complex and constantly changing, making it easy to make errors when preparing your taxes. A tax professional can ensure that your tax returns are accurate, minimizing the risk of triggering an audit or facing penalties for underpayment or incorrect reporting.

With their expertise and knowledge of current tax regulations, a tax advisor will help you navigate through potential pitfalls while maximizing deductions and credits to optimize your financial situation.

Downsides to Hiring a Tax Professional

Potential lack of control and need for ongoing communication and involvement may be perceived as downsides to hiring a tax professional.

Cost

Hiring a tax professional comes with its own costs. Tax advisors charge fees for their services, and these fees can vary depending on the complexity of your tax situation and the level of expertise required.

It’s important to consider whether the potential benefits outweigh the cost in your specific circumstances. While it may seem like an additional expense, hiring a tax advisor can save you money in the long run by helping you take advantage of deductions and credits that you may have overlooked on your own.

Additionally, they can help prevent costly mistakes or penalties that could arise from incorrectly filing your taxes. Though there is a financial investment involved, many individuals find that working with a tax advisor is worth it for the peace of mind and expert guidance they provide when navigating through complex tax laws and regulations.

In addition to monetary costs, hiring a tax professional also requires ongoing communication and involvement from both parties. You will need to gather all relevant financial documents and provide them to your advisor so they can accurately prepare your taxes.

Throughout this process, there needs to be clear communication between you and your advisor about any changes in income or expenses that may affect your tax situation. This collaboration ensures comprehensive and accurate tax returns are filed on time.

Potential for lack of control

Hiring a tax professional can be beneficial, but it’s important to consider the potential for lack of control. When you work with a tax advisor, you are essentially entrusting someone else to handle your financial matters.

This means that you may have less input and control over the decision-making process. It’s crucial to choose a trustworthy and competent tax advisor who will keep you informed and involve you in key decisions.

By doing so, you can mitigate the risk of feeling disconnected from your own finances and ensure that your goals are being prioritized.

Need for ongoing communication and involvement

To ensure a successful relationship with your tax advisor, ongoing communication and involvement are essential. Regularly staying in touch and providing necessary information will help your tax advisor understand your financial goals and make informed decisions on your behalf.

It is important to promptly respond to any inquiries or requests for documents to avoid delays in the tax preparation process. Additionally, remaining involved throughout the year by discussing any major life changes or financial decisions will enable your tax advisor to proactively manage and optimize potential tax issues.

By maintaining open lines of communication and actively participating in the tax planning process, you can achieve comprehensive and accurate tax returns that align with your overall financial strategy.

Considerations for Choosing a Tax Advisor

When choosing a tax advisor, it’s important to consider their qualifications and certifications, availability, communication style and approach, trust and confidentiality, as well as the potential for a long-term relationship.

Qualifications and certifications

Tax advisors with the right qualifications and certifications can provide valuable assistance when it comes to managing your taxes. Some important qualifications to consider include:

- Certified Public Accountant (CPA): CPAs have undergone extensive education and testing to earn their certification. They are well-versed in accounting and tax planning, ensuring that you receive accurate guidance.

- Experience: Look for a tax advisor with experience in handling situations similar to yours. Someone who has dealt with complex tax issues or specializes in specific industries may be beneficial.

- Continuing Education: Tax laws and regulations are constantly changing, so it’s crucial to work with an advisor who stays updated through ongoing education or membership in professional organizations.

- Referrals and Reviews: Seek recommendations from trusted sources or look for reviews online to gauge the advisor’s reputation and track record of success.

- Licensing: Confirm that the advisor holds the necessary licenses required by your jurisdiction, such as a valid state license or registration with relevant authorities.

- Professional Affiliations: Membership in professional associations, such as the American Institute of Certified Public Accountants (AICPA), can indicate a commitment to ethical standards and ongoing professional development.

- Specializations: Depending on your specific needs, you may prefer an advisor who specializes in areas like investment taxation, estate planning, or small business taxes.

Availability

Tax advisors are readily available to assist you with your tax needs. Whether you prefer face-to-face meetings, phone consultations, or email correspondence, most tax advisors offer flexible availability to accommodate your schedule.

This ensures that you can easily connect with them when questions arise or when you need assistance in preparing and filing your taxes accurately and on time. With their expertise just a call away, hiring a tax advisor provides the convenience and peace of mind knowing that professional help is always available whenever you require it.

Communication style and approach

A tax advisor’s communication style and approach are important factors to consider when choosing the right professional for your needs. Effective communication ensures that you understand each other and can work together efficiently.

Some tax advisors may prefer face-to-face meetings, while others may be comfortable with phone or email correspondence. It’s essential to find a tax advisor with a communication style that aligns with your preferences and availability.

Additionally, their approach should be proactive and responsive, so you feel confident in their ability to address your concerns promptly and provide timely updates on the progress of your tax matters.

Trust and confidentiality

You need to be able to trust your tax advisor with sensitive financial information. Confidentiality is crucial when it comes to sharing personal and financial details. You want to work with a tax advisor who understands the importance of keeping your information private and secure.

Trust and confidentiality go hand in hand, ensuring peace of mind as you navigate complex tax matters together.

Potential for long-term relationship.

Choosing a tax advisor has the potential for developing a long-term relationship that can benefit your financial goals. When you find the right tax advisor, you can work together year after year to manage and optimize your tax issues.

This ongoing relationship allows your tax advisor to become familiar with your financial situation, providing comprehensive and accurate tax returns tailored to your specific needs.

With their expertise, you can navigate changing tax laws and regulations while maximizing deductions and avoiding penalties. Investing in a long-term partnership with a trusted tax professional ensures that you have someone knowledgeable by your side for all of your future tax preparation needs.

Conclusion

In conclusion, hiring a tax advisor can offer numerous benefits to individuals and businesses. From saving time and avoiding costly mistakes to maximizing tax savings and navigating complex tax laws, a tax advisor can provide valuable expertise and support.

However, it is important to carefully consider the cost, potential lack of control, and ongoing communication required when deciding whether to hire a tax professional. Ultimately, choosing the right tax advisor who meets your specific needs and goals is crucial for managing your taxes effectively.