Avoiding Tax Pitfalls: A Freelance Writer’s Guide

Nailing the freelance writing gig can be a dream come true, but it often leaves many grappling with their taxes. Shockingly, about 20% of small businesses – including freelance writers – get dinged by IRS penalties each year for common tax mistakes! Fret not because this article is loaded with helpful advice to help navigate these murky waters and keep your finances shipshape.

Ready to dive in?.

Key Takeaways

- Not paying self – employment tax can lead to penalties and missed deductions for freelance writers. It’s important to start planning for these taxes if annual earnings exceed $400.

- Mixing personal and business expenses can trigger a tax audit or penalties. Establish clear divisions between costs associated with your writing career and unrelated expenditures.

- Neglecting retirement savings is a common mistake that can result in missed tax deductions and financial difficulties later in life. Prioritize setting aside money for retirement as a freelance writer.

- Neglecting health care contributions leaves freelancers without coverage and misses out on potential tax deductions. Allocate funds towards health care expenses to maximize available benefits.

The Importance of Tracking Your Finances

Keeping exact records of income and expenses is crucial for freelance writers. With accurate financial tracking, you can ensure you’re setting aside the right amount for taxes and not overpaying or underpaying.

An accounting system specifically designed for freelancers will help in maintaining organized bookkeeping, accurately calculating self-employment tax, as well as identifying potential business deductions.

Identifying deductible expenses can be a major perk of financial tracking. Your office supplies, professional courses, even your home office could qualify for write-offs when filing taxes as a freelancer.

The more precise your record keeping is the less likely it is that you’ll face an IRS audit. Using good finance tracking strategies gets you one step closer to stress-free tax filing.

Common Tax Mistakes Freelance Writers Make

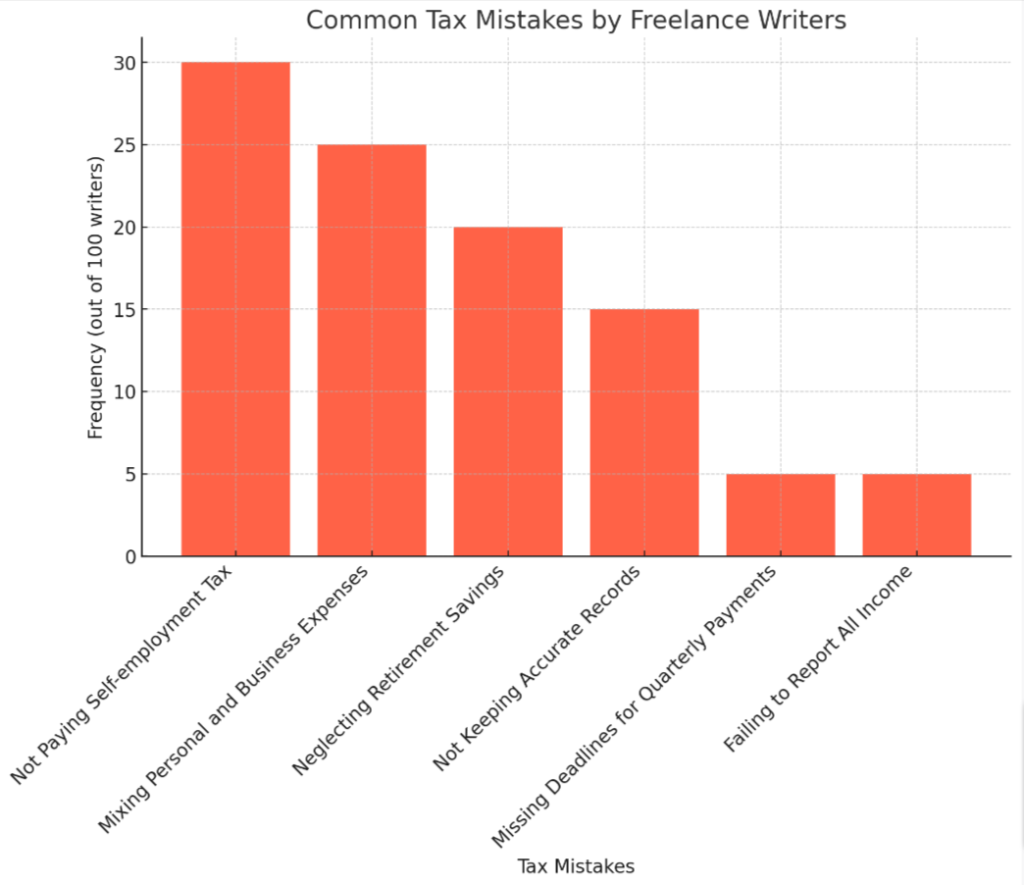

Freelance writers often make the mistake of not paying self-employment tax, mixing personal and business expenses, neglecting retirement savings, and neglecting health care contributions.

Not paying self-employment tax

Freelance writers often overlook their obligation to pay self-employment tax. This is a common mistake that can lead to penalties and fines from the IRS. The self-employment tax covers Social Security and Medicare contributions, which would typically be paid by an employer in traditional employment situations.

A general rule for freelancers is: if annual earnings exceed $400, it’s time to start planning for self-employment taxes. Freelance writers shouldn’t fall into the trap of delaying these payments.

Not only could there be financial consequences, but missed opportunities as well, such as not being able to claim deductions on certain business expenses or missing out on future Social Security benefits due to under-reporting income.

Mixing personal and business expenses

Blurring the lines between personal and business expenses constitutes a common tax error made by independent writers. Freelance writers easily fall into this trap, as they often work from home or use their devices for both professional and private tasks.

It’s crucial to establish clear divisions between all costs associated with your writing career and other expenditures unrelated to conducting business. The IRS regulations for freelance writers place a heavy emphasis on maintaining separate accounts and thorough record-keeping to ensure accurate reporting of income and expenses on their taxes.

Incorrectly claiming personal outlays as business deductions can trigger a tax audit or lead to penalties, which harms your bottom line in the long run. So, set up an accounting system built around precision – it fosters transparency when calculating estimated tax payments, tracking deductible expenses for authors, making retirement contributions or tallying any prepublication costs incurred during your creative process.

Even simple measures like using different credit cards for personal purchases versus business needs lend themselves greatly toward preserving these boundaries.

Neglecting retirement savings

Neglecting retirement savings is a common tax mistake that many freelance writers make. It’s easy to focus on the present and forget about planning for the future, but saving for retirement is crucial.

By neglecting to set aside money for retirement, you could miss out on valuable tax deductions and face financial difficulties later in life. As a freelance writer, it’s important to prioritize your long-term financial security by exploring retirement savings options such as individual retirement accounts (IRAs) or simplified employee pension plans (SEPs).

Start saving early and regularly contribute to your retirement fund to ensure a comfortable future.

Neglecting health care contributions

Neglecting health care contributions can be a costly mistake for freelance writers. As self-employed individuals, freelancers are responsible for securing their own health insurance.

Failing to allocate funds towards health care contributions not only leaves freelancers vulnerable without coverage, but it also means missing out on potential tax deductions. It is crucial for freelance writers to prioritize their health by budgeting and allocating funds towards health care expenses, ensuring they have the necessary coverage while also maximizing available tax benefits.

Tax Tips for Freelance Writers

Keep your finances organized and track all potential deductions to maximize your tax savings. Understand the self-employment tax and how it applies to you as a freelance writer. Consider whether operating as a sole proprietorship or forming an LLC would be more beneficial for your business.

Lastly, don’t hesitate to seek professional tax advice if you’re unsure about any aspect of filing your taxes.

Keep organized and track deductions

To properly manage your taxes as a freelance writer, it is essential to keep organized and track your deductions. Here are some key tips to help you stay on top of your finances:

- Maintain a separate bank account for your business expenses.

- Keep detailed records of all your income and expenses, including invoices, receipts, and bank statements.

- Categorize your expenses correctly to ensure accurate reporting.

- Regularly update your accounting system or use accounting software to simplify the process.

- Set aside time each month to review and reconcile your financial records.

- Familiarize yourself with the tax deductions available to freelance writers, such as office supplies, professional development courses, and home office expenses.

- Consider consulting with a tax professional to ensure you are maximizing your deductions and taking advantage of any tax credits that apply to you.

Understanding the self-employment tax

Understanding the self-employment tax is crucial for freelance writers. This tax, also known as the SE tax, is a contribution that self-employed individuals must make to Social Security and Medicare.

Unlike traditional employees who have these taxes withheld from their paychecks by their employers, freelancers are responsible for calculating and paying these taxes themselves. The self-employment tax rate is typically 15.3%, which includes both the employer and employee portions of Social Security and Medicare taxes.

It’s important for freelance writers to understand this tax obligation so they can properly calculate and set aside funds throughout the year to ensure they meet their tax obligations come filing season.

Sole proprietorship or LLC?

Deciding whether to remain a sole proprietor or to form an LLC is an important decision freelance writers have to make when organizing their business structure. It impacts how taxes are handled and has potential implications for personal liability.

| Sole Proprietorship | LLC (Limited Liability Company) | |

|---|---|---|

| Definition | A business owned and run by one person where the law does not distinguish between the business and the owner. | A legal entity where members are not personally liable for the company’s debts or liabilities. |

| Tax Filing | Income and losses are reported on the owner’s personal tax return. | Can be taxed as a sole proprietor, partnership, or corporation depending on the number of members and the entity’s choice. |

| Liability | The owner is personally responsible for all the firm’s debts and obligations. | Members are generally not personally liable for the company’s debts. |

| Decision Making | Decisions are solely made by the owner. | Decisions can be made by members or managers depending on the operating agreement. |

Consider the implications and benefits of each structure and, if necessary, seek professional advice to choose the one that suits your business the best.

Getting professional tax advice

Don’t navigate the complex world of freelance taxes alone. Seek out professional tax advice to ensure you’re making the right financial decisions. A tax professional can provide guidance on deductions, help you better understand self-employment tax obligations, and advise on whether it’s best for you to operate as a sole proprietor or form an LLC.

With their expertise, you can maximize your deductions and minimize any potential audit risks. Remember, a little professional advice can go a long way in saving you time and money when it comes to filing your taxes as a freelance writer.

Conclusion

Freelance writers often make common tax mistakes that can be costly. Failing to pay self-employment tax, mixing personal and business expenses, neglecting retirement savings, and ignoring health care contributions are some of the errors they make.

To avoid these missteps, it’s important for freelance writers to stay organized, understand self-employment tax, consider their business structure, and seek professional tax advice when needed.

By being proactive and informed about their tax obligations as freelancers, writers can avoid unnecessary headaches come tax time.