Crafting a Secure Financial Path: Planning for Freelancers

Navigating finances can be a real challenge for freelancers. In fact, according to a recent study, nearly 60% of freelancers have trouble managing their financial stability due to unpredictable income.

This blog post aims to provide practical advice and strategies regarding financial planning, helping you guarantee your future as a freelancer. Are you ready for a better freelance future?.

Key Takeaways

- Financial planning is crucial for freelancers to ensure a stable income and achieve long – term goals such as retirement or purchasing a home.

- Differentiating between profit and revenue helps freelancers maximize profitability by managing expenses effectively.

- Maintaining a budget allows freelancers to track spending, prioritize savings, and reduce unnecessary financial stress.

- Tracking expenses helps freelancers make informed decisions about their spending and identify areas where they can cut costs.

- Timing projects strategically allows freelancers to optimize earnings by taking advantage of high – demand periods and maintaining steady income throughout the year.

- Setting short-term and long-term financial goals provides direction in financial planning and ensures that finances are on track in the short term while building future security.

- Separating personal and business expenses is essential for accurate tracking of cash flow, better budgeting, simplified tax preparation, and informed decision-making when planning for future goals.

Understanding Financial Planning for Freelancers

Financial planning is crucial for freelancers as it allows them to differentiate between profit and revenue, maintain a budget, track expenses, and time projects for maximum profitability.

Importance of financial planning

The core of a successful freelance career lies in effective financial planning. It provides a clear picture of where money is coming from and going, helping freelancers to foresee potential financial issues before they occur.

A well-strategized plan supports day-to-day survival, allowing for savings, facilitating debt repayment and securing an emergency fund. Financial planning not only ensures sustainable income but also helps in achieving long-term goals such as retirement or purchasing a home.

Differentiating between profit and revenue

Revenue is the total amount of money that a company earns from its business activities. For freelancers, this involves payments received from clients for services rendered. On the other hand, profit refers to what remains after all business expenses have been deducted from the revenue.

It’s essential to understand these differences because they play a significant role in your financial planning habits.

For instance, you might generate high revenue by taking on multiple projects at once, but if your operational costs are also high (like buying new equipment or outsourcing some tasks), your profit may be low.

Therefore, it’s not just about earning more but also managing expenses to maximize profitability for effective financial management as a freelancer.

The necessity of maintaining a budget

Maintaining a budget stands as the cornerstone of successful financial planning for freelancers. It provides a clear picture of income and expenses, helping to identify where money is being spent and how much left.

Budgeting ensures that you always have sufficient funds to cover your necessities, creates room for saving, and reduces unnecessary financial stress. A thoroughly planned budget prevents overspending and helps in setting aside enough money for taxes.

With careful budgeting, you’re not just surviving paycheck to paycheck but steadily moving towards financial stability; it’s like paving a concrete path towards achieving your freelance financial goals.

Tracking expenses

Tracking expenses is a crucial aspect of financial planning for freelancers. It helps you understand where your money is going and enables you to make informed decisions about your spending. By keeping an accurate record of your expenses, you can identify areas where you may be overspending and find ways to cut costs.

Additionally, tracking expenses allows you to create a realistic budget that aligns with your income and financial goals. Here are some effective strategies for tracking your expenses as a freelancer:

- Use expense tracking apps or software to easily record and categorize your expenses.

- Keep all receipts and invoices organized in one place for easy reference.

- Regularly review your bank and credit card statements to ensure accuracy.

- Separate personal and business expenses by maintaining separate accounts or using designated cards for each.

- Set aside time each week or month to review and update your expense records.

- Analyze your spending patterns over time to identify trends and make adjustments accordingly.

Timing projects for maximum profitability

Timing projects for maximum profitability is a key aspect of financial planning for freelancers. By strategically scheduling your projects, you can optimize your earning potential.

This involves considering factors such as market demand, competition, and seasonal trends. By identifying peak periods and aligning your project schedule accordingly, you can ensure that you are taking advantage of high-demand periods and maximizing your profits.

Additionally, by spreading out projects during slower times, you can maintain a steady income throughout the year. Being mindful of timing when it comes to project selection allows freelancers to maximize their earning potential and achieve financial stability in their freelance careers.

Setting Financial Goals

Setting financial goals is essential for freelancers to ensure they have a clear direction and purpose in their financial planning journey.

Short-term and long-term goals

Setting short-term and long-term goals is crucial for effective financial planning as a freelancer. Short-term goals help you stay focused on immediate objectives, such as paying off debt or saving for an emergency fund.

These goals provide motivation and ensure that your finances are on track in the short term. On the other hand, long-term goals lay the foundation for your future financial security, such as retirement planning or buying a home.

By setting both short-term and long-term goals, you can create a clear roadmap to achieve financial stability and success as a freelancer.

Creating a budget to achieve these goals

To achieve your financial goals as a freelancer, it is essential to create a budget that aligns with your objectives. Here are steps to guide you in creating a budget:

- Determine your income sources: Identify all the ways you generate income as a freelancer, such as client projects or side gigs.

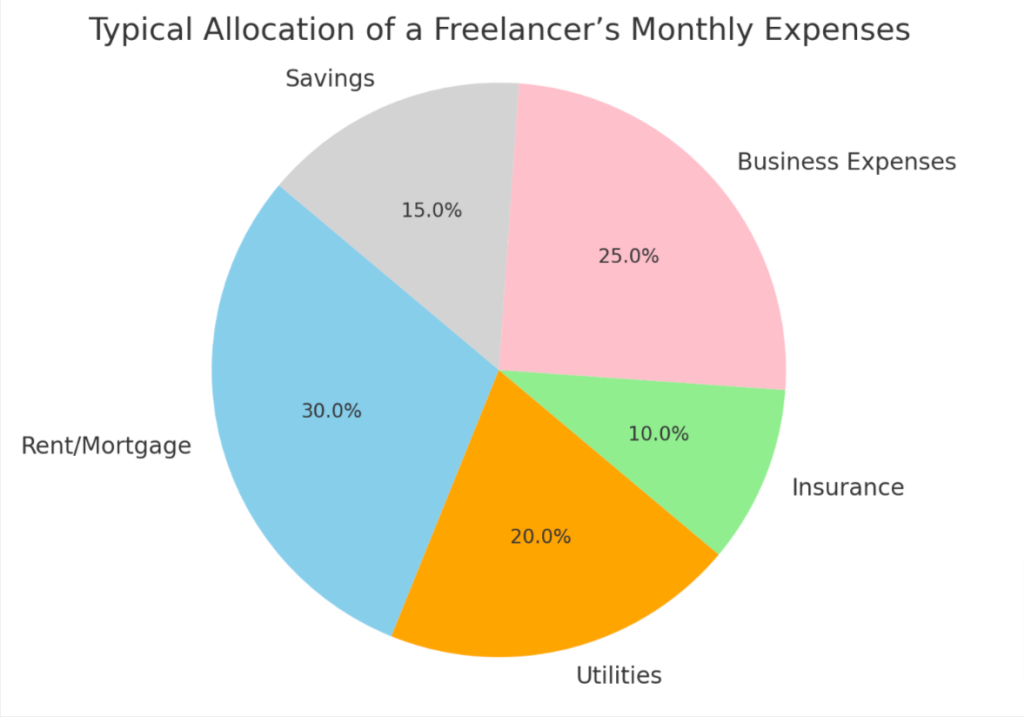

- Calculate fixed expenses: List all your regular monthly expenses that remain relatively constant, such as rent/mortgage, utilities, and insurance premiums.

- Track variable expenses: Keep track of discretionary or variable expenses like dining out, entertainment, and shopping. This will help you see where you can potentially cut back and save.

- Prioritize savings: Allocate a portion of your income towards savings or investments. Set aside money for emergencies and future financial goals.

- Allocate funds for business expenses: If there are specific costs associated with running your freelance business, like software subscriptions or marketing tools, make sure to include them in your budget.

- Review and adjust regularly: Once you have created your initial budget, review it regularly to ensure it remains aligned with your financial goals. Make adjustments as needed to reflect changes in income or expenses.

Importance of separating personal and business expenses

To ensure financial stability as a freelancer, it is crucial to separate personal and business expenses. By keeping these two categories distinct, freelancers can gain a clear understanding of their income and expenditures, making it easier to track their cash flow accurately.

This separation allows for better budgeting and expense management, ensuring that personal spending does not overlap with business funds. Additionally, separating expenses simplifies tax preparation by providing a clear record of deductible business expenses.

Ultimately, maintaining this distinction helps freelancers maintain financial organization and make informed decisions when planning for future goals.

Strategies for Managing Finances as a Freelancer

Paying down debt, setting aside money for taxes, building an emergency fund, diversifying income streams, investing wisely, and considering insurance and retirement planning are all important strategies for managing finances as a freelancer.

Paying down debt

To achieve financial stability as a freelancer, it is essential to prioritize paying down debt. By tackling your outstanding debts head-on, you can reduce the burden of interest payments and free up more money for future endeavors.

Start by creating a realistic budget that allocates funds towards debt repayment each month. Consider strategies such as the snowball or avalanche method to determine the most effective way to pay off multiple debts.

As you make progress, celebrate small victories and stay motivated on your journey toward financial freedom.

Setting aside money for taxes

Freelancers need to be proactive in setting aside money for taxes. Since freelancers are responsible for paying their own taxes, it’s important to allocate a portion of their income to cover this expense.

By setting aside money regularly, freelancers can avoid being caught off guard when tax season arrives. This ensures that they have the funds necessary to meet their tax obligations and prevents any financial strain or penalties.

Setting aside money for taxes should be a priority in the freelancer’s budgeting and financial planning routine.

Building an emergency fund

Building an emergency fund is a crucial step in financial planning for freelancers. This fund serves as a safety net during unexpected situations, providing the necessary funds to cover unforeseen expenses or periods of low income.

By setting aside money regularly, freelancers can gradually build up their emergency fund over time. Having this financial cushion allows freelancers to navigate through challenging times without having to rely on credit cards or loans.

It provides peace of mind and ensures stability in their freelance career, giving them the confidence to take risks and pursue new opportunities.

Diversifying income streams

Diversifying income streams is a crucial strategy for managing finances as a freelancer. By relying on multiple sources of income, you can reduce the risk of financial instability and increase your earning potential.

This can be done by offering different services or products, targeting various client industries, or exploring additional revenue streams such as affiliate marketing or passive income opportunities.

Diversification not only provides stability but also opens up new opportunities for growth and expansion in your freelance career. By actively seeking out diverse income streams, freelancers can ensure they have a steady flow of money coming in while also increasing their chances of long-term success.

Investing wisely

Investing wisely is a crucial aspect of financial planning for freelancers. By making smart investment decisions, you can grow your wealth and secure your future. Explore different investment options, such as stocks, bonds, real estate, or even starting your own business.

Consider working with a financial advisor who can help you navigate the intricacies of investing and develop an investment strategy that aligns with your goals and risk tolerance. Remember to regularly review and adjust your investments as needed to stay on track towards achieving financial stability and success in your freelance career.

Considering insurance and retirement planning

Insurance and retirement planning are essential components of financial stability for freelancers. As a freelancer, you are responsible for your own insurance coverage, including health insurance and liability insurance.

It is important to carefully consider the types of coverage you need to protect yourself and your business from potential risks.

Retirement planning is also crucial as a freelancer since you don’t have access to an employer-sponsored retirement plan like a 401(k). You’ll need to take proactive steps to save for your golden years.

This can include opening an individual retirement account (IRA) or SEP-IRA and contributing regularly towards it.

The Power of Networking and Staying Informed

Building connections in the freelance community and staying up-to-date on financial trends and resources can provide valuable insights and opportunities to enhance your financial planning.

Discover how networking and staying informed can help you thrive as a freelancer.

Building connections in the freelance community

Building connections in the freelance community is crucial for your financial success. It can provide you with valuable opportunities and support. Here are some ways to build those connections:

- Attend industry events and conferences

- Join online forums and communities for freelancers

- Participate in networking events and meet – ups

- Collaborate with other freelancers on projects

- Reach out to potential clients or mentors through social media platforms

Staying up-to-date on financial trends and resources

Being aware of the latest financial trends and resources is crucial for freelancers looking to stay ahead in their industry. By staying informed, you can make informed decisions about your finances and adapt your strategies accordingly.

Keep an eye on industry news, subscribe to relevant newsletters, and follow influential thought leaders in finance. Additionally, take advantage of online resources such as webinars, podcasts, and blogs that provide valuable insights into financial planning for freelancers.

Regularly investing time in learning and staying up-to-date will give you a competitive edge and help ensure your long-term financial success as a freelancer.

Leveraging tools and technology for financial management

Embrace the power of tools and technology to effectively manage your finances as a freelancer. Take advantage of the following resources to stay organized and in control:

- Use accounting software like QuickBooks or Xero to track income, expenses, and invoices.

- Utilize budgeting apps such as Mint or Personal Capital to create and monitor your budget.

- Explore expense tracking apps like Expensify or Zoho Expense to keep a record of your business – related expenses.

- Consider using project management tools like Trello or Asana to stay on top of deadlines and ensure timely payments.

- Implement time – tracking apps like Toggl or Harvest to accurately bill clients for the hours worked.

- Invest in tax software like TurboTax or H&R Block to simplify the tax filing process and maximize deductions.

- Leverage digital payment platforms such as PayPal, Venmo, or Stripe for easy and secure transactions with clients.

- Explore investment platforms like Robinhood or Vanguard to grow your savings and plan for long – term financial stability.

Conclusion

In conclusion, financial planning is crucial for freelancers to secure a stable future. By setting clear goals, managing finances strategically, staying informed about industry trends, and building a strong network of connections, freelancers can navigate the challenges of variable income and achieve long-term financial success.

Start implementing these tips today to prepare yourself for a thriving freelance future.