Broadening Your Client Base: The Power of Income Diversification

Do you have a single client that’s the main income source for your business? You are not alone, but this dependency can create financial instability and hinder your growth. This article will offer you some practical steps to diversify your income and lessen the risks associated with relying on one principal client.

Ready for more financial stability and growth opportunities? Let’s dive in!

Key Takeaways

- Relying solely on one client for income can lead to financial instability and hinder business growth.

- Dependence on a single client’s payment leaves you vulnerable to delays or defaults, disrupting your cash flow.

- Changes in a client’s plans or their business shutting down can result in an immediate loss of revenue and financial instability.

- Diversifying your income by attracting multiple clients reduces the risk of one entity having too much bargaining power.

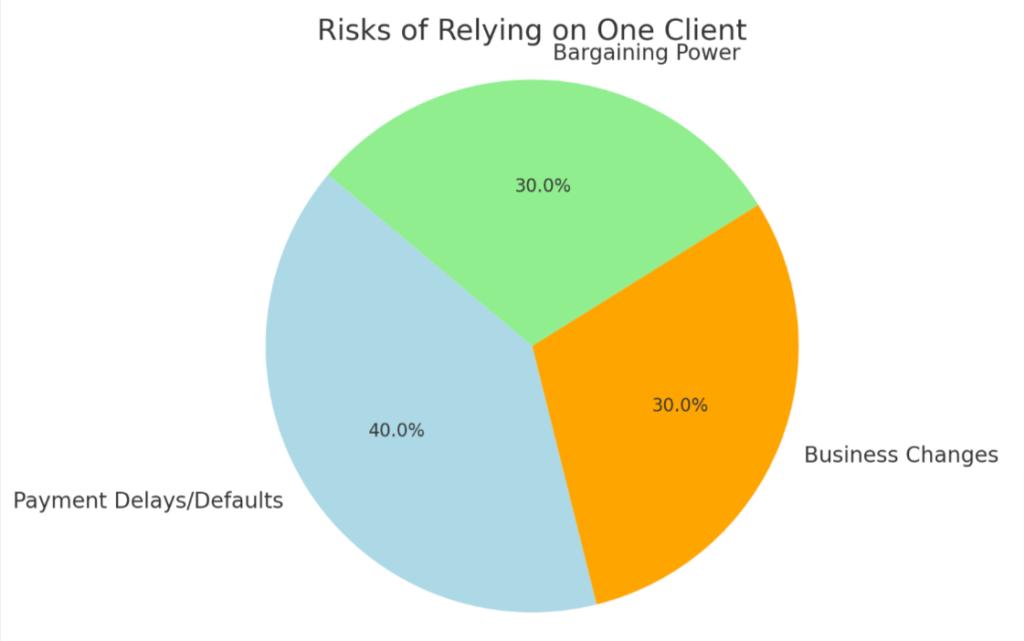

The Risks of Relying on One Client

Relying solely on one client for your income can be risky due to potential changes in their plans or even them going out of business, causing a loss of revenue.

Dependence on their payment

Relying heavily on a single client for income places your financial stability at their mercy. If they delay or default on payment, it can throw your cash flow into disarray, leading to potential financial difficulties.

It’s crucial to maintain multiple reliable streams of income to avoid this trap. Dependence creates vulnerability and limits flexibility in managing unpredictable circumstances, creating a risky business environment where you are at the whim of the client’s ability and willingness to pay.

Changing plans or going out of business

Any business can experience unforeseen circumstances that force them to alter their operations or even shut down completely. Clients, no matter how reliable they may appear initially, are not exempt from such occurrences.

An abrupt change in your client’s business plan could severely impact your revenue stream and leave you scrambling to pick up the pieces.

Business shutdowns are another critical consideration when relying on a single client for income. If your sole client goes out of business, it immediately results in an entire loss of your revenue source.

Such a drastic blow can lead to financial instability, potentially jeopardizing the longevity of your own operations. It is essential for strategic diversification and risk management to prepare for these uncertainties.

Having too much bargaining power

A single client dominating your income stream can wield significant bargaining power. They know you rely on them, so they might attempt to negotiate for lower rates or demanding more work without increase in pay.

This situation places undue pressure on the business owner and may lead to unfavorable compromises just to retain the client’s patronage. Diversifying your income by attracting multiple clients can balance out this power dynamic, ensuring no single entity holds too much influence over your financial stability.

Impact on the value of your business

Relying on just one client can have a significant impact on the value of your business. When your entire revenue is dependent on a single source, it greatly increases the risk involved.

If something were to happen to that client, such as them changing their plans or going out of business, you could face serious financial instability. Additionally, having only one client gives them too much bargaining power over your prices and terms.

This lack of diversification can also deter potential buyers if you ever decide to sell your business in the future. By diversifying your client base, you not only reduce dependency but also increase the overall value and stability of your business.

Diverting resources

Diverting resources is a common issue when relying on one client for your income. When you put all your eggs in one basket, you end up dedicating most of your time, energy, and resources to serving that one client.

This means that other potential sources of income may be neglected or overlooked. By diversifying your income streams and not being solely dependent on one client, you can allocate your resources more effectively and explore new opportunities for growth.

The Importance of Diversification for Your Income

Diversifying your income is crucial for reducing risk and boosting sales growth.

Reducing risk

Reducing risk is a crucial reason why diversifying your income is important. By relying on one client, you put yourself at the mercy of their payment and any changes they may make to their plans or if they go out of business.

Additionally, having too much bargaining power can negatively impact your business’s value. Diversification allows you to spread the risk across multiple clients and industries, reducing your vulnerability to sudden changes or disruptions in the market.

It provides a safety net that helps protect your financial stability and ensures long-term success for your business.

Boosting sales growth

Diversifying your income streams is not just about reducing risk, it can also have a significant impact on boosting sales growth. By expanding your client base and offering a variety of products or services, you increase your potential to attract more customers and generate higher revenue.

This strategic approach allows you to tap into different markets and reach new audiences, ultimately driving the growth of your business. With multiple sources of income, you are better positioned to adapt to changing market conditions and seize opportunities for expansion.

So, don’t limit yourself to just one client – diversify your income for long-term sales growth.

Strategies for Diversifying Your Income Streams

To diversify your income streams, consider offering a variety of products or services to attract different customers. Targeting different markets or audiences can also help expand your reach and increase sales opportunities.

Creating passive income streams, such as through investments or rental properties, can provide additional sources of revenue. Additionally, exploring expansion into new industries can open up new avenues for growth and income generation.

Offering a variety of products or services

Expanding your income sources involves offering a variety of products or services. It allows you to tap into different customer needs and preferences, ensuring a steady stream of revenue. By diversifying your offerings, you can attract a wider range of customers and increase your sales potential. Additionally, it reduces the risk of relying on one specific product or service that may become obsolete or less popular in the future.

This strategy enables you to adapt and thrive in changing market conditions, leading to long-term financial stability.

Targeting different markets/audiences

Expanding your business by targeting different markets and audiences can help to diversify your income streams. By reaching out to new customer segments, you can tap into untapped potential and increase your revenue opportunities. Here are some strategies to consider:

- Identifying niche markets that align with your products or services

- Conducting market research to understand the needs and preferences of different customer groups

- Tailoring your marketing messages and communication channels to effectively reach each target audience

- Developing partnerships or collaborations with businesses that cater to different markets

- Customizing your offerings or creating new product lines to meet the specific demands of diverse customers

Creating passive income streams

Creating passive income streams is a smart strategy to diversify your income and reduce reliance on a single client. Here are some ways you can create passive income streams:

- Invest in rental properties or real estate crowdfunding.

- Build an online course or e – book that generates income through sales.

- Create an app or software that generates revenue through subscriptions or licensing fees.

- Start a blog or YouTube channel and monetize it through advertising, sponsorships, or affiliate marketing.

- Purchase dividend – paying stocks or invest in index funds for regular income.

Expanding into new industries

Expanding into new industries can offer significant opportunities for income diversification. Here are some strategies to consider:

- Identify industries that align with your skills and expertise.

- Research market trends and potential profitability in those industries.

- Develop relationships with key players and industry leaders.

- Adapt your products or services to meet the needs of the new industry.

- Invest in training or education to gain the necessary knowledge.

- Build a strong marketing strategy to attract customers in the new industry.

- Gradually transition your focus from existing clients to new industry prospects.

Conclusion

Diversifying your income is crucial to protect yourself from the risks of relying on a single client. By spreading your sources of revenue, you can reduce dependence and increase financial stability.

Don’t put all your eggs in one basket- explore new opportunities and secure long-term success for your business.