Crafting Compelling Content in Finance Writing

Navigating the world of personal finance can often feel like a daunting maze. In fact, surveys reveal that only 57% of Americans are financially literate. This blog post is your guide to understanding and managing your finances more effectively – from everyday budgeting to long-term investing strategies.

Ready to transform confusion into confidence? Read on!

Key Takeaways

- Financial literacy is crucial for individuals of all ages as it empowers them to make better financial decisions and navigate the complex world of money management.

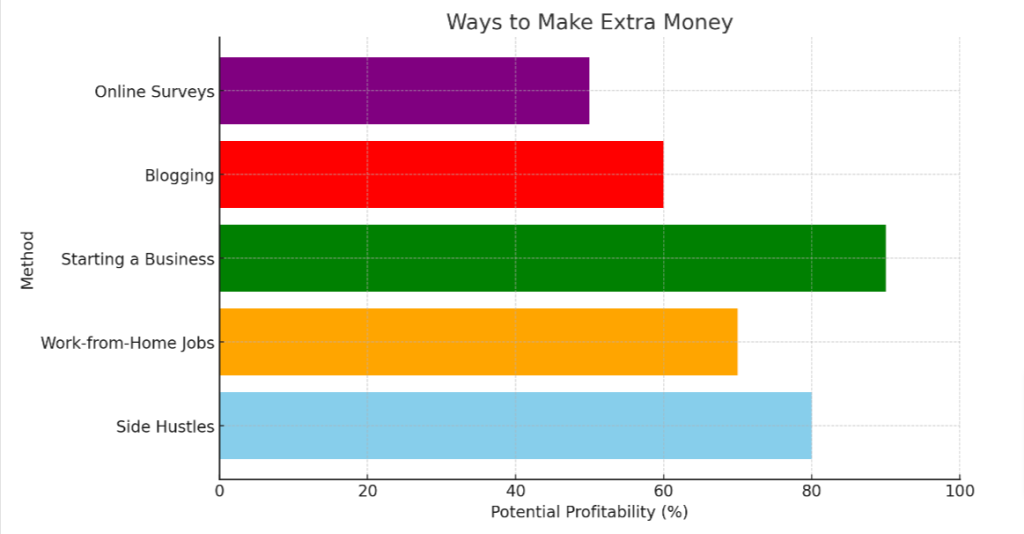

- There are various ways to make extra money, such as engaging in side hustles, working from home jobs, starting a business, making money through blogging, and participating in paid online surveys.

- Strategies for successful financial management include creating a budget, saving and investing wisely, managing credit and debt effectively, and making a solid financial plan for the future.

The Importance of Financial Literacy

Financial literacy is crucial for individuals of all ages as it empowers them to make better financial decisions and navigate the complex world of money management.

Teaching children about money

Early financial education can make a great difference in children’s lives. It gives them the necessary tools to handle their finances responsibly as they grow older. To start, use everyday situations, like shopping or budgeting for family vacations, as practical lessons on spending and saving.

Explain concepts such as earning, spending wisely and saving consistently. Encourage kids to save some of their allowance or gift money rather than spending all at once. Show them how small amounts can add up over time if saved regularly.

Introduce the concept of investing by showing how their savings could grow through interest in a bank account or investments in stocks and bonds.

Making better financial decisions

Mastering the art of financial decision-making can dramatically improve your life. Good choices lead to less stress, more freedom and a sense of security. Smart spending should top your list – buy what you need before what you want.

Secondly, make saving a priority; treat it as a bill that needs to be paid every month. Learning about investments opens doors to passive income that grows over time. Don’t shy away from seeking professional help if things get tricky; financial advisors provide valuable guidance for retirement planning or complex situations.

Finally, always maintain an emergency fund because unexpected expenses are part of life. Practice these strategies consistently to elevate your financial intelligence and secure your future assets.

Ways to Make Extra Money

There are various ways to make extra money, such as engaging in side hustles, working from home jobs, starting a business, making money through blogging, and participating in paid online surveys.

Side hustles

Tapping into side hustles can provide a financial boost. There are many successful methods to earn extra income, some of which include:

- Selling handmade crafts or vintage items on Etsy.

- Starting a freelance writing, design, or coding business.

- Renting out an unused room or property on Airbnb.

- Offering personal services like pet – sitting, personal shopping, or house cleaning.

- Driving for ride – share companies like Uber or Lyft in your free time.

- Teaching online classes in a subject you’re proficient in.

- Creating and selling online courses or ebooks.

- Buying items at thrift stores and reselling them online for a profit.

Work from home jobs

Many opportunities exist for work from home jobs that can provide additional income. Consider the following options:

- Virtual Assistant: Assist professionals with tasks such as scheduling, email management, and research.

- Freelance Writer: Write articles, blog posts, or website content for businesses or individuals.

- Online Tutor: Teach subjects like math, English, or languages through online tutoring platforms.

- Graphic Designer: Create visual content, logos, or marketing materials for clients remotely.

- Social Media Manager: Manage social media accounts and create engaging content for businesses.

- Web Developer: Build and maintain websites for clients from the comfort of home.

- Transcriptionist: Listen to audio recordings and convert them into written documents.

- Customer Service Representative: Assist customers with inquiries and concerns via phone or chat.

- Data Entry Specialist: Input data into spreadsheets or databases remotely for various companies.

- Online Survey Taker: Participate in paid surveys to earn money in your spare time.

Starting a business

Starting a business can be an exciting and rewarding endeavor. It provides the opportunity to turn your passion into a profitable venture. Whether it’s selling handmade products, offering a specialized service, or creating innovative solutions, starting a business allows you to be your own boss and take control of your financial future.

With the right planning and strategy, you can build a successful business that generates revenue and provides you with the flexibility and freedom that comes with being an entrepreneur.

Begin by identifying your target market, developing a solid business plan, securing funding if necessary, and implementing effective marketing strategies to reach potential customers.

Making money through blogging

Blogging has evolved from a mere hobby into a lucrative source of income. By creating valuable and engaging content, bloggers can attract a large following and monetize their blogs in various ways.

One way to make money through blogging is by displaying advertisements on your site. Ad networks like Google AdSense allow bloggers to earn revenue based on the number of ad impressions or clicks generated.

Another option is affiliate marketing, where bloggers promote products or services and receive a commission for each sale made through their referral links. Additionally, sponsored posts and brand collaborations can provide bloggers with opportunities to earn money by partnering with companies that align with their niche.

Paid online surveys

Paid online surveys offer a convenient way to make some extra money from the comfort of your own home. By signing up for reputable survey websites, you can participate in online surveys and get paid for sharing your opinions on various topics.

These surveys are typically short and can be completed in your spare time. It’s a great way to earn some additional income without having to commit to a regular job or side hustle.

Plus, it’s simple and straightforward – all you need is an internet connection and a device to complete the surveys on. Start exploring paid online surveys today and start earning money for giving your valuable feedback!

Strategies for Successful Financial Management

Create a budget, save and invest wisely, manage credit and debt effectively, and make a solid financial plan for the future.

Creating a budget

To successfully manage your finances, it is essential to create a budget. This will help you keep track of your income and expenses, and make informed financial decisions. Follow these steps to create a budget:

- Determine your income: Start by calculating all the money you earn each month from your job, freelance work, or any other sources of income.

- List your expenses: Make a comprehensive list of all your monthly expenses, including rent/mortgage payments, utilities, groceries, transportation costs, entertainment, and any other recurring expenses.

- Differentiate between fixed and variable expenses: Fixed expenses are those that stay the same each month (e.g., rent), while variable expenses can vary (e.g., groceries). Categorize each expense accordingly.

- Set financial goals: Identify short-term and long-term financial goals you want to achieve. This could include saving for a vacation, paying off debt, or building an emergency fund.

- Allocate funds: Allocate a portion of your income towards each expense category based on its priority and importance in helping you achieve your financial goals.

- Track and adjust: Regularly monitor your spending throughout the month to ensure you stay within budget. If necessary, make adjustments by cutting back on non-essential expenses.

Saving and investing

Saving and investing are crucial aspects of financial management. They provide opportunities to build wealth and secure a stable future. Here are some strategies to help you make the most of your money:

- Create a budget: Setting a budget allows you to track your expenses and find areas where you can save.

- Start an emergency fund: Having a cushion of savings for unexpected expenses provides peace of mind and prevents financial setbacks.

- Automate savings: Set up automatic transfers from your checking account to a separate savings account to ensure consistent saving.

- Diversify investments: Spreading your investments across different assets reduces risk and maximizes potential returns.

- Consider retirement accounts: Take advantage of employer-sponsored plans like 401(k)s or individual retirement accounts (IRAs) to save for retirement tax-free or with tax advantages.

- Research investment options: Educate yourself on different investment vehicles such as stocks, bonds, mutual funds, or real estate before making investment decisions.

- Regularly review and adjust your portfolio: Stay updated with market trends and periodically rebalance your investments based on your risk tolerance and goals.

Managing credit and debt

Managing credit and debt is a crucial aspect of successful financial management. It involves effectively using credit cards, loans, and other forms of borrowed money while keeping track of payments and maintaining a good credit score.

By managing credit wisely, individuals can avoid falling into debt traps and maintain financial stability. This includes paying bills on time, keeping credit card balances low, and avoiding unnecessary debts.

Additionally, developing a debt repayment plan helps to prioritize payments and reduce interest charges. With proper management strategies in place, it becomes easier for individuals to build a positive credit history and achieve their long-term financial goals without being burdened by excessive debt.

Making a financial plan for the future

Creating a financial plan for the future is essential for long-term financial success. It involves setting goals, outlining strategies to achieve those goals, and regularly reviewing your progress.

By mapping out your financial journey, you can make informed decisions about saving, investing, and budgeting. This proactive approach ensures that you are prepared for unexpected expenses and on track to meet your retirement goals.

Taking control of your finances now will set you up for a secure and comfortable future.

Conclusion: Take Control of Your Finances and Live More Comfortably

Take control of your finances and start making better financial decisions today. By understanding the importance of financial literacy, exploring ways to make extra money, and implementing strategies for successful financial management such as budgeting and saving, you can pave the way towards a more comfortable future.

Don’t wait any longer – take charge of your financial journey now!