Navigating Tax Season: A Freelancer’s Financial Primer

Navigating through tax season can be a daunting task for any freelance writer. Did you know that there are specific IRS guidelines and deductible business expenses aimed at your profession? This guide demystifies the complexities of freelance writer taxes, from understanding various deductions to adhering to self-employment regulations.

Let’s dive into making your tax filing smoother and smarter!

Key Takeaways

- Freelance writers are responsible for various types of taxes, including federal and state income tax, self-employment tax, local taxes, estimated taxes, and sales tax on physical products.

- Schedule C is a crucial form for freelance writers to report their income and deduct allowable expenses. It helps determine the amount of income subject to taxes.

- Freelance writers can take advantage of deductions such as the home office deduction and health insurance deduction to lower their taxable income.

- Tracking business expenses accurately throughout the year allows freelance writers to maximize deductions and reduce their taxable income. Choosing the right business entity is also important for maximizing tax benefits.

Understanding Taxes for Freelance Writers and Self-Published Authors

Freelance writers and self-published authors need to understand the types of taxes they are responsible for, such as self-employment tax, and how to complete Schedule C for their business income.

Additionally, they can take advantage of deductions like the home office deduction and health insurance deduction.

Types of taxes for freelance writers

Freelance writers are subject to various types of taxes. They are:

- Federal income tax: This is based on the net income from your freelance writing business.

- State income tax: Depending upon where you live, you might owe state income tax as well.

- Self-employment tax: This covers Social Security and Medicare taxes, which freelancers are solely responsible for paying.

- Local taxes: Some cities or counties may also levy a local tax on freelance income.

- Estimated taxes: These are quarterly payments that writers often need to make if they expect to owe more than $1,000 in taxes for the year.

- Sales tax: If you sell physical products like books or merchandise, you may be required to charge sales tax.

Completing Schedule C

Filling out the IRS Schedule C form is a crucial step for freelance writers during tax season. This critical document reports all income and losses from your business. It displays how much you’ve earned as a freelancer, and it helps identify exactly what percentage of this income should be dedicated to taxes.

Schedule C also offers opportunities to lower your taxable income. You can list all allowable deductions, such as home office expenses or cost of goods sold, on this form. Any valid business expense reduces the total amount that’s subject to self-employment tax.

By accurately completing Schedule C, you’re ensuring your freelance writing venture remains financially healthy while meeting its tax obligations.

Home office deduction

Freelance writers often work from their homes, making the home office deduction a significant benefit. This tax break allows you to account for a portion of your rent or mortgage interest, utilities, and other expenses related to maintaining your workspace at home.

The Internal Revenue Service (IRS) requires that this area be used exclusively and regularly as your main place of business. Freelance photographers and authors alike can take advantage of this opportunity to lower their taxable income.

Consult with an accounting expert or use reliable tax software for precise calculations on how much you can save with the home office deduction.

Self-employment tax

Freelance writers and self-published authors are responsible for paying self-employment tax on their income. This tax covers Social Security and Medicare, just like regular employees pay through payroll deductions.

To calculate your self-employment tax, you’ll need to complete Schedule SE along with your federal income tax return. It’s important to keep track of your freelance income throughout the year so that you can accurately report it and calculate your self-employment tax obligation.

Remember to consult a financial adviser or an accounting expert if you have any questions or need help navigating the complexities of self-employment taxes.

Health insurance deduction

Freelance writers and self-published authors can take advantage of the health insurance deduction to reduce their taxable income. By deducting the cost of health insurance premiums, freelancers can lower their overall tax liability.

It’s important to keep track of all healthcare expenses and consult with a financial advisor or tax professional to ensure eligibility for this deduction. Taking advantage of the health insurance deduction can help freelancers save money and increase their net income.

Maximizing Tax Deductions as a Freelance Writer

Track all your business expenses to maximize tax deductions, choose the right business entity for tax benefits, and take advantage of deductible expenses such as office supplies and travel costs.

Additionally, consider using self-employment taxes for retirement savings and explore the deduction options for Qualified Business Income.

Tracking business expenses

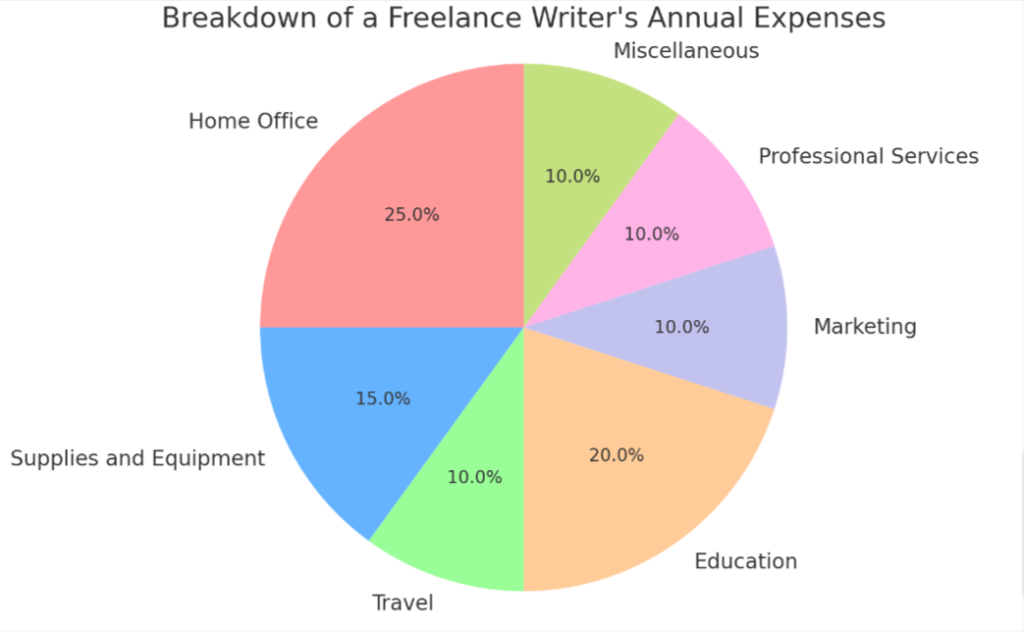

As a freelance writer, it’s crucial to track your business expenses accurately. This allows you to maximize your tax deductions and potentially reduce your taxable income. Keep detailed records of all purchases related to your writing business, such as office supplies, software subscriptions, research materials, and marketing expenses.

Use online tools or apps specifically designed for expense tracking to simplify the process. By diligently tracking your business expenses throughout the year, you’ll have everything you need come tax time to ensure you’re taking advantage of every eligible deduction available to you.

Choosing the right business entity

When it comes to managing your taxes as a freelance writer, choosing the right business entity is crucial. The type of entity you select will determine how your income is taxed and what deductions you can claim.

Whether you opt for a sole proprietorship, partnership, or an LLC, each option has its own benefits and considerations. It’s important to consult with a financial adviser or accounting expert who specializes in freelance income to ensure that you make the best decision for your specific circumstances.

By selecting the right business entity, you can maximize your tax deductions and minimize any potential liabilities.

Deductible expenses

Deductible expenses for freelance writers and self-published authors include:

- Office supplies

- Computer equipment

- Internet and phone bills

- Website hosting and domain fees

- Research material and books

- Professional memberships and subscriptions

- Marketing and advertising expenses

- Travel expenses related to work

- Home office expenses (rent, utilities, etc.)

- Health insurance premiums

Using self-employment taxes for retirement savings

Freelance writers have the opportunity to use their self-employment taxes for retirement savings. Instead of relying solely on a traditional employer-sponsored 401(k) plan, freelancers can set up their own individual retirement accounts (IRAs).

By contributing to an IRA, freelancers can take advantage of potential tax benefits while saving for their future. It’s important for freelance writers to consult with a financial adviser or accounting expert who specializes in self-employed individuals to understand how much they can contribute and what type of IRA is best suited for their needs.

Saving for retirement through self-employment taxes is a proactive way for freelance writers to secure their financial future.

Contributing regularly from your net income as a freelancer into an IRA allows you to reduce your taxable income while building your retirement nest egg. The contributions made are tax-deductible, meaning that you won’t be taxed on them until you withdraw funds during retirement.

This not only provides potential tax advantages but also helps freelance writers ensure they have sufficient savings when they’re ready to retire and transition away from active work.

Deducting Qualified Business Income

When filing taxes as a freelance writer, it’s important to understand how to deduct qualified business income. Qualified business income refers to the net income generated from your freelance writing activities.

This includes any income you earn from selling articles or books, royalties received, and fees for services rendered. By deducting this qualified business income, you can reduce your taxable income and potentially lower your overall tax liability.

To determine the deductible amount, you’ll need to calculate your total qualified business expenses and subtract them from your total qualified business income. These expenses may include costs for research materials, computer equipment, software subscriptions, marketing expenses, and professional development courses.

Filing Taxes as a Freelance Writer

Filing taxes as a freelance writer involves understanding 1099 forms, filing for traditionally published or self-published books, and other writer-related income, and filling out Schedule C and Schedule SE.

Understanding 1099 forms

Freelance writers need to understand 1099 forms, which are used to report income received from clients. These forms are issued by clients who have paid you $600 or more during the tax year.

The information on the 1099 form, such as your name, address, and social security number, will be used by the IRS to track your income and ensure that you pay the appropriate taxes.

You should expect to receive a copy of this form from each client who meets this threshold for payment. It is important to keep these forms organized and accurate when filing your taxes as a freelance writer.

Filing for traditionally published books

Freelance writers who have traditionally published books also need to consider the tax implications of their income. When it comes to filing taxes for traditionally published books, it’s important to report your royalties as part of your freelance income.

This means including the royalty payments on your Schedule C form and calculating your net income accordingly. Be sure to keep track of all book-related expenses, such as promotional costs or fees paid to literary agents, as these can be deducted from your taxable income.

By understanding the specific tax obligations for traditionally published authors and accurately reporting your earnings, you can ensure that you stay in compliance with IRS guidelines while maximizing deductions where applicable.

Filing for self-published books

To properly file taxes for your self-published books, you will need to include the income and expenses related to your writing business on your tax return. This can be done by filling out Schedule C, which allows you to report your self-employment income and deduct eligible business expenses.

Remember to keep track of all the records and receipts pertaining to your book sales and publishing costs so that you can accurately calculate your net income from self-publishing.

By accurately reporting this information, you can ensure that you fulfill your tax obligations as a self-published author without any complications.

Filing for other writer-related income

Freelance writers may have income from sources other than their writing projects that need to be reported on their tax returns. Here are some examples of writer-related income that should be filed:

- Speaking engagements

- Teaching writing workshops or classes

- Literary prizes or awards

- Royalties from songs or scripts

- Income from freelance editing or proofreading jobs

- Income from freelance photography related to writing projects

Filling out Schedule C and Schedule SE

Filling out Schedule C and Schedule SE is an important part of filing taxes as a freelance writer. Schedule C is where you report your business income and deductible expenses, such as office supplies or advertising costs.

It helps determine your net profit or loss from freelancing. On the other hand, Schedule SE calculates your self-employment tax based on your freelance income. Make sure to accurately fill out both forms to ensure you’re meeting your tax obligations as a self-employed writer.

Tips and Resources for Freelance Writer Taxes

Learn how to make estimated quarterly tax payments, choose the right business code, and maximize common deductions for freelance writers.

Understanding estimated quarterly tax payments

Freelance writers and self-employed individuals often have to make estimated quarterly tax payments to the IRS. These are advance payments of your tax liability for the current year, spread out over four installments.

By paying these quarterly taxes, you can avoid a big tax bill at the end of the year and any potential penalties for underpayment.

To calculate your estimated tax payment, you’ll need to estimate your taxable income for the year and determine how much you owe in federal taxes. You can use Form 1040-ES provided by the IRS or consult with a financial adviser or accounting expert to help you figure it out.

Choosing the right business code

Choosing the right business code is an important step when it comes to managing your taxes as a freelance writer. The business code you select helps the IRS understand what type of work you do and how it should be categorized for tax purposes.

It’s crucial to choose a code that accurately represents your freelance writing activities, whether you focus on prose, verse, or other types of creative writing. By selecting the appropriate business code, you can ensure that your income and expenses are correctly reported, maximizing your deductions and minimizing any potential issues with the IRS.

Paying estimated taxes

Freelance writers are responsible for paying estimated taxes throughout the year. This means that you need to estimate your income and calculate how much tax you owe on a quarterly basis.

To make these payments, use IRS Form 1040-ES or pay online through the Electronic Federal Tax Payment System (EFTPS). By staying up-to-date with your estimated tax payments, you can avoid penalties and interest charges later on.

Common deductions for freelance writers

Freelance writers can benefit from several common deductions that can help lower their taxable income. These deductions include:

- Office expenses, such as rent, utilities, and office supplies.

- Professional development costs, including workshops, conferences, and subscriptions to industry publications.

- Advertising and marketing expenses for promoting your writing services.

- Research materials, such as books or online subscriptions necessary for writing projects.

- Travel expenses related to business trips or research for articles or books.

- Internet and phone expenses used exclusively for work purposes.

- Software and equipment purchases directly related to your freelance writing business.

- Professional services fees paid to editors, proofreaders, or graphic designers.

- Health insurance premiums if you are self – employed and not eligible for coverage through a spouse’s plan.

- Contributions to retirement plans like a Simplified Employee Pension (SEP) IRA or Solo 401(k).

Conclusion.

In conclusion, managing your taxes as a freelance writer or self-published author can seem daunting at first, but with the right knowledge and resources, it can be manageable. By understanding the types of taxes you need to pay, maximizing tax deductions, filing your taxes correctly, and utilizing tips and resources available to freelancers, you can navigate the world of freelance writer taxes more confidently.

Remember to keep track of your business expenses and consult with a financial advisor or accounting expert if needed. With proper planning and organization, you can stay on top of your tax obligations while maximizing deductions and saving for retirement.