Weighing Your Income Options: Monthly Versus Project-Based Earnings

Navigating the world of income can feel like a maze, especially when you’re weighing up monthly versus project-based earnings. In the US, about 35% of the workforce are now freelancers, displaying a shift towards more flexible work structures.

This blog post will provide clarity on both these earning methods and help you make an informed decision that best suits your financial stability and professional goals. Are you ready to unlock your optimal income strategy? Let’s dive in!

Key Takeaways

- Monthly recurring revenue (MRR) provides consistent income and financial stability, making it easier to cover expenses and plan for the future.

- Project – based income offers higher pay per project, allowing freelancers to earn more for their work. It also provides variety in work and the potential for passive income.

- Drawbacks of MRR include a lack of control over income and heavy reliance on clients. Project-based income can be inconsistent, making budgeting and planning difficult. Constantly searching for new projects is also a challenge with project-based income.

Understanding Monthly Recurring Revenue (MRR)

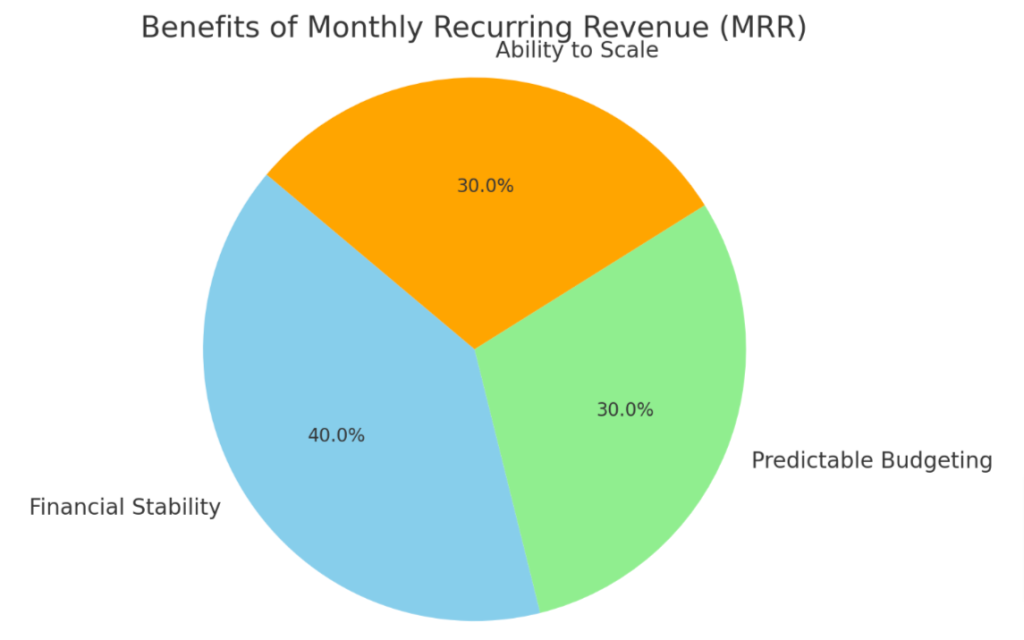

Monthly Recurring Revenue (MRR) is a type of income that provides consistency and predictability, making it easier to budget and scale your business.

Consistent income

Earning a steady paycheck every month brings the relief of financial security. This kind of consistent income allows for a stable lifestyle, reducing the worry of how to cover basic expenses like rent and food.

Bills become less intimidating when you have predictable cash flow coming in each month. Furthermore, many lenders look favorably upon regular monthly earnings when considering loan applications or credit extensions, opening up more opportunities for major purchases such as homes or cars.

Predictable budgeting

Predictable budgeting thrives on a monthly recurring income model. This type of revenue allows organizations to forecast their financial future with higher certainty. It’s like having a clear road map of the cash flow, helping to lay down effective strategies for controlled spending and saving.

Having a predictable budget streamlines the management of operational expenses too. Companies can effectively plan for sustained growth, potential investments, or mitigating risk when they know what resources are assured every month.

Furthermore, this financial stability can also contribute significantly towards improving client retention and business scalability over time due to lowered economic uncertainties.

Ability to scale

Scaling your business becomes possible with a monthly recurring revenue model. It allows you to invest in growth opportunities and expand operations without substantial financial risk.

A stable income stream ensures sufficient funds for hiring more employees, purchasing necessary equipment, or exploring new markets. In contrast, project-based income can make scaling more challenging due to its unpredictable nature.

Therefore, businesses seeking scalability might find the monthly model more advantageous for their long-term growth objectives.

Benefits of a Project-Based Income

Project-based income offers several benefits. First, it often results in higher pay per project, allowing freelancers and contractors to earn more for their work. Second, project-based income provides variety in work, as individuals can take on different projects and expand their skill sets.

Lastly, there is potential for passive income through project-based work, as successful projects may lead to royalties or residual payments in the future.

Higher pay per project

Project-based income has the advantage of offering higher pay per project, which can be very enticing. Compared to a monthly salary, where there is a set amount that you receive regardless of the actual work done, project-based income allows you to earn more for the specific projects you complete.

This can result in increased earning potential and financial reward for your efforts. By taking on individual projects, you have the opportunity to negotiate rates that reflect your skills and expertise, ensuring that your hard work is adequately compensated.

Variety in work

Having a project-based income offers the benefit of variety in work. Instead of being tied to one specific job or industry, individuals who work on projects have the opportunity to engage in a wide range of tasks and projects.

This not only keeps things interesting but also allows for professional growth and development as skills are constantly being challenged and expanded. By working on different projects with different clients, individuals can gain exposure to new industries, experiences, and challenges that can help them build a diverse portfolio and increase their marketability.

In addition to providing professional growth opportunities, variety in work also brings personal fulfillment. Rather than being confined to the same routine day after day, those with project-based income get the chance to explore different interests and pursue their passions through various assignments.

Whether it’s designing websites one month or writing marketing strategies the next, this flexibility allows individuals to continuously evolve professionally while enjoying what they do.

Potential for passive income

With project-based income, there is a potential for passive income. This means that once you complete a project, you may continue to earn money from it without having to actively work on it anymore.

For example, if you create an online course or write a book, you can continue to earn royalties or sales revenue even after the initial work is done. This offers an opportunity for residual income and the chance to build multiple streams of revenue over time.

Drawbacks of MRR

Lack of control over income and heavy reliance on clients can make monthly recurring revenue a risky option. Want to know more about the drawbacks? Keep reading!

Lack of control over income

Managing your income can be challenging when you have a project-based payment structure. Unlike monthly income, where you can rely on a steady paycheck, project-based income is unpredictable and often irregular.

This lack of control over your income means that you may experience periods with high pay followed by times of financial instability. Without a consistent stream of work or guaranteed clients, it can be difficult to plan and budget effectively.

Additionally, the need to constantly find new projects adds an extra layer of stress and uncertainty to your financial situation.

Heavy reliance on clients

Projects that rely heavily on clients for income can pose a challenge. Since the income is not recurring, it becomes difficult to predict how much money will be coming in each month.

This lack of control over income can lead to financial uncertainty and make budgeting and planning more complicated. Additionally, heavy reliance on clients means constantly searching for new projects, which can be time-consuming and may put strain on maintaining a steady workflow.

It’s important to carefully evaluate this aspect before deciding whether a project-based income model is right for you.

Drawbacks of Project-Based Income

Inconsistent income, difficulty in budgeting and planning, constantly searching for new projects – these are just a few of the challenges that come with project-based income. Find out more about the drawbacks of this payment model and why it may not be the best choice for everyone.

Read on to learn more!

Inconsistent income

Project-based income can unfortunately come with the drawback of inconsistency. As a freelancer or contractor, you may find yourself facing periods without any projects, resulting in a lack of income during those times.

This unpredictability can make it difficult to plan and budget effectively, as you never know when your next paycheck will come in. Additionally, constantly searching for new projects to sustain your income can be time-consuming and stressful.

Difficulty in budgeting and planning

Budgeting and planning can be challenging when relying on project-based income. Since the income is not consistent, it becomes harder to predict how much money will come in each month.

This inconsistency can make it difficult to set a budget and plan for expenses effectively. Freelancers or those with project-based income may find themselves constantly adjusting their financial plans due to the fluctuating nature of their earnings.

Without a steady stream of revenue, it can be hard to maintain stability and effectively manage finances.

Constantly searching for new projects

Freelancers who rely on project-based income often face the challenge of constantly searching for new projects. Unlike those with regular monthly pay, they don’t have a steady stream of work to rely on.

This means they need to actively seek out new opportunities and market themselves to potential clients. It can be time-consuming and require consistent effort to find new projects that align with their skills and interests.

However, this constant search also allows freelancers the flexibility to choose the types of projects they want to work on and explore different areas of expertise.

Conclusion

Deciding between monthly and project-based income ultimately depends on your personal preferences and financial goals. Monthly recurring revenue (MRR) offers consistent income and easier budgeting, while project-based income can provide higher pay per project and more variety in work.

Consider the drawbacks too – MRR can mean less control over your earnings, while project-based income comes with the challenge of constantly searching for new projects. Evaluate your priorities to determine which option is better suited for you.