Dealing With Slow Periods: Tips To Keep The Cash Flowing

Are sluggish business periods hitting your cash flow? You’re not alone – managing finances during slow times is a common challenge for many businesses. This blog post will provide you with practical strategies to keep the money circulating even in quiet seasons.

Intrigued? Let’s dive into the sea of solutions for steady cash flow!

Key Takeaways

- Understand the different types of cash flow, such as operating, investing, financing, and free cash flow, to effectively manage your finances during slow periods.

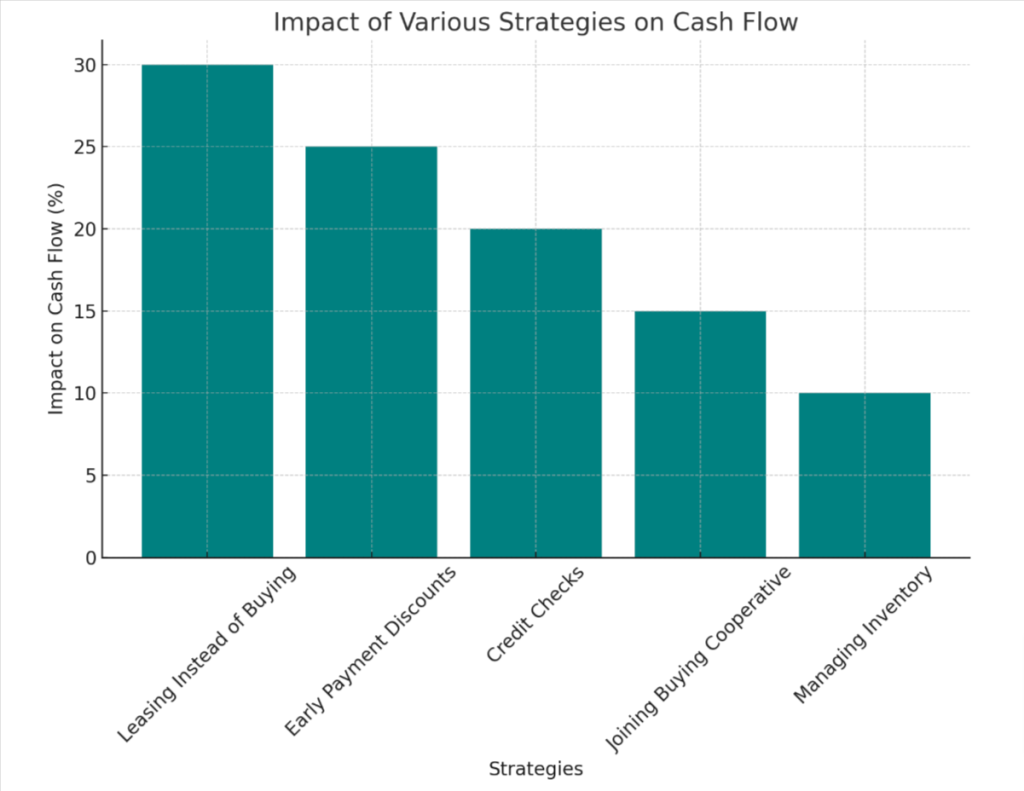

- Implement strategies like leasing instead of buying, offering early payment discounts to customers, conducting credit checks on clients, joining a buying cooperative, and managing inventory efficiently to improve cash flow.

- Accurately project expenses and revenue, save money during busy times by cutting costs and streamlining operations. Analyze ongoing projects and adjust accordingly. Be flexible with labor and explore financing options to keep your business afloat during slow periods.

Understanding Cash Flow During Slow Periods

Cash flow refers to the movement of money into and out of a business during a specific period, including slow periods. There are two types of cash flow: positive cash flow, where the inflow exceeds the outflow, and negative cash flow, where the outflow exceeds the inflow.

Definition of cash flow

Cash flow refers to the money that is moving in and out of your business. It’s a critical aspect as it determines your company’s solvency – its capacity to meet short-term obligations, like monthly expenses and payroll.

Think of it as the lifeblood of any business; enough cash flow lets you cover costs, invest in new opportunities, or weather downturns. Comparably, negative cash flow could lead to bankruptcy due to an inability to sustain operations if prolonged over time.

At its core, understanding and managing cash flow is crucial for long-term business survival and growth.

Types of cash flow

Cash flow in a business comes in varied forms. Let’s uncover the main categories:

- Operating Cash Flow: This involves the money earned from regular business operations. Selling goods, providing services, and other daily transactions contribute to this flow.

- Investing Cash Flow: It represents the money being used or generated through investment activities. Purchasing property or selling assets are a few examples.

- Financing Cash Flow: This cash flow covers interactions with investors and creditors. It includes terms of loans, shareholder dividends, and equity transactions.

- Free Cash Flow: This extra cash can be used for expansion, paying off debt, or added to reserves for future use.

Strategies for Improving Cash Flow

To improve cash flow, consider leasing equipment instead of buying it outright, offering early payment discounts to incentivize prompt payments from customers, conducting thorough credit checks on potential clients to minimize the risk of late or non-payment, joining a buying cooperative to benefit from bulk purchasing power and lower costs, and managing inventory efficiently to reduce carrying costs.

Leasing instead of buying

Leasing assets or equipment can significantly enhance your cash flow during slow periods. Unlike purchasing, leasing does not require large upfront costs, freeing up capital to invest in other areas of your business.

It also offers flexibility, as lease terms usually range from one to five years and often include options for upgrades or purchase at the end of the term. This option gives you access to cutting-edge technology without investing heavily in items that depreciate quickly.

Leased items are also easier on maintenance expenses since most contracts cover repairs and servicing within the lease term. On top of it all, taxes become easier to manage because lease payments qualify as a business expense on your tax return which lowers taxable income.

Offering early payment discounts

One effective strategy for improving cash flow during slow periods is to offer early payment discounts. By providing incentives for customers to pay their invoices ahead of schedule, you can accelerate the inflow of cash into your business.

This not only helps improve your current cash flow situation but also reduces the risk of late or unpaid invoices. By encouraging prompt payments through discounts, you can maintain a steady stream of income and strengthen your financial stability.

It’s a win-win situation that benefits both your business and your customers.

Conducting customer credit checks

Conducting customer credit checks is a crucial step in managing cash flow during slow periods. By assessing the creditworthiness of your customers before extending them credit, you can minimize the risk of late or non-payment.

This helps to ensure a steady flow of money into your business. By examining factors such as payment history, outstanding debts, and financial stability, you can make informed decisions about granting credit terms to customers.

Implementing this practice can help you avoid potential cash flow issues caused by unpaid invoices and reduce the need for collection efforts.

Joining a buying cooperative

Joining a buying cooperative can be a smart move for businesses looking to improve their cash flow during slow periods. By pooling resources and purchasing power with other businesses, you can negotiate better prices from vendors and suppliers.

This allows you to reduce your expenses and increase your profit margins. Additionally, being part of a buying cooperative gives you access to variable payment terms, which can help alleviate any cash flow crisis by providing more flexibility in managing receivables and invoices.

Managing inventory efficiently

Managing inventory efficiently is crucial for maintaining a healthy cash flow, especially during slow periods. By keeping a close eye on your inventory levels and optimizing your stock management, you can prevent unnecessary expenses and ensure that you have the right amount of products on hand to meet customer demand.

Regularly analyze your sales data to identify trends and adjust your inventory accordingly. By accurately projecting future sales, you can avoid overstocking or running out of popular items.

Additionally, consider implementing technology solutions such as automated inventory systems or barcode scanning to streamline the process and improve accuracy. Efficient inventory management will help you minimize costs, maximize profitability, and keep cash flowing smoothly in your business.

Tips for Managing Cash Flow During Slow Periods

To manage cash flow during slow periods, accurately project your expenses and revenue, save money during busy times, analyze ongoing projects and adjust accordingly, be flexible with labor, and explore financing options.

Projecting accurately

Accurate projection is crucial for managing cash flow during slow periods. By predicting your future expenses and income, you can make informed decisions and take proactive steps to preserve cash flow.

Start by reviewing historical data and trends to identify patterns in your business’s performance. Consider factors such as seasonality, industry changes, or customer behavior that may impact your revenue streams.

Use this information to develop realistic projections for the upcoming months or even years. Updating these projections regularly will help you stay on top of any potential deficits and allow you to adjust your strategies accordingly.

Saving money during busy times

To save money during busy times, it’s important to be mindful of your expenses and make smart choices. Look for ways to cut costs, such as negotiating better terms with vendors or finding alternative suppliers who offer lower prices.

You can also streamline your operations by optimizing processes and reducing waste. By being proactive and making strategic decisions, you can maintain financial stability even during the busiest periods of your business.

Analyzing projects and adjusting accordingly

Analyzing projects and adjusting accordingly is a crucial strategy for managing cash flow during slow periods. Here are some tips to help you navigate through these challenging times:

- Review your current projects and assess their profitability.

- Identify any projects that are not generating enough revenue or have excessive expenses.

- Consider adjusting the scope of these projects or reallocating resources to more profitable ones.

- Monitor project timelines and identify any potential delays or bottlenecks.

- Communicate with clients and stakeholders about any necessary adjustments or changes in project plans.

- Continuously track and compare actual project costs against budgeted costs.

- Look for opportunities to optimize processes or reduce expenses without sacrificing quality.

- Stay flexible and be willing to make quick decisions based on the changing project landscape.

Being flexible with labor

Being flexible with labor is essential during slow periods to help manage cash flow effectively. One way to achieve this is by cross-training employees so they can perform different tasks and fill in gaps when necessary.

This flexibility allows businesses to avoid hiring additional staff during slow periods, which helps reduce costs. Additionally, businesses can consider implementing flexible schedules or part-time arrangements for employees to match the workload demands more efficiently.

By being adaptable with labor, businesses can optimize their resources and maintain productivity even during slower times.

Exploring financing options

- Seek out small business loans from banks or credit unions in your area.

- Consider applying for a line of credit that can be used during slow periods to cover expenses.

- Look into crowdfunding platforms as a way to raise funds for your business.

- Explore grants and funding opportunities offered by government agencies or non – profit organizations.

- Consider partnering with an investor who can provide the necessary funds to help keep your cash flow steady.

Conclusion: Keeping Your Business Afloat During Slow Periods

To keep your business afloat during slow periods, it’s important to actively manage your cash flow. By implementing strategies such as leasing instead of buying, offering early payment discounts, conducting customer credit checks, and joining a buying cooperative, you can improve your cash flow and minimize unnecessary expenses.

Additionally, by accurately projecting, saving money during busy times, analyzing projects and adjusting accordingly, being flexible with labor, and exploring financing options, you can effectively manage your cash flow during slow periods and ensure the continued success of your business.