Tackling Late Payments: A Freelancer’s Guide to Diplomacy and Resolution

Are you frustrated with late payments and seeking a professional way to handle things? You’re not alone; research shows that small businesses spend an average of 10 days a year chasing late payments.

This blog will provide you with practical tips, strategies, and valuable resources for managing overdue invoices professionally. Get ready to reclaim your time – read on!

Key Takeaways

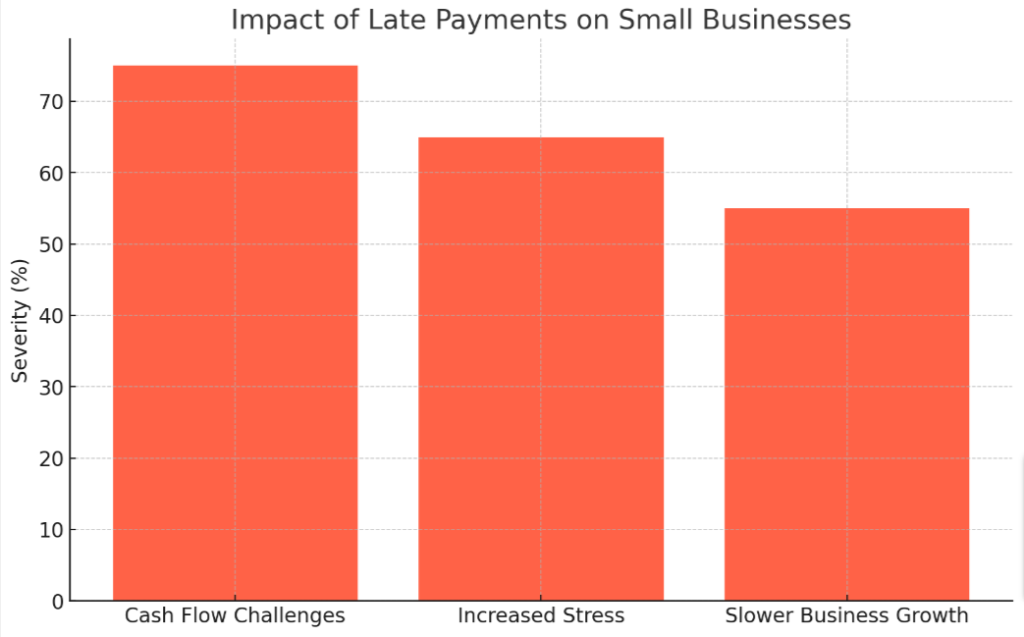

- Late payments can have detrimental effects on small businesses, including cash flow challenges, increased stress, and slower business growth.

- To prevent late payments, create clear payment terms in contracts, maintain positive customer relationships, and have a late payment policy in place.

- When handling late payments, start with polite follow – ups, be persistent in communication, consider legal action if necessary, and utilize online tools to streamline the process.

- An innovative funding solution like FundThrough can help businesses avoid the negative impact of late payments by providing immediate funding and eliminating the need for collections.

The Impact of Late Payments on Small Businesses

Late payments can have detrimental effects on small businesses, leading to cash flow challenges, increased stress, and slower business growth.

Cash flow challenges

Late payments can wreak havoc on a business’s cash flow, making it difficult to cover essential expenses. This lack of funds might result in skipped vendor payments, delayed employee salaries and inability to restock inventory timely.

Even profitable businesses can fail if their cash flow is inconsistent or insufficient. Companies need reliable revenue streams to manage their day-to-day operations smoothly without financial disruptions from outstanding customer payments.

This shows the critical need for effective strategies and tools that ensure timely payment collection from customers, thereby preserving the company’s financial stability.

Increased stress and less time for important work

Increased stress due to late payments can seriously affect your productivity and overall wellbeing. It’s not just about the funds; it also involves the constant worry of managing cash flow, paying bills, or even making payroll.

This level of stress might lead to burnout and reduced efficiency in performing other critical tasks.

Moreover, chasing after late payments is a time-consuming task that eats into hours you could be using for more important work. It can hinder your business growth as instead of focusing on scaling operations or improving products and services, you’re left attempting to collect overdue invoices from late-paying customers.

Slow business growth

Late payments can significantly slow down business growth. They tie up funds that could be used for reinvestment or the expansion of your operations. Instead of focusing on strategies to grow your business, time and resources are spent chasing overdue invoices.

Stagnant cash flow due to late-paying customers can also delay hiring new employees and hamper production.

This ripple effect reverberates throughout the entire structure of a small enterprise. Late payments stifle innovation as they limit the available resources needed for research and development.

They potentially block opportunities to explore new markets or launch novel products. The inability to invest in marketing efforts further hinders visibility, influencing customer perception negatively and slowing overall business growth.

How to Prevent Late Payments

To prevent late payments, it is crucial to create a contract with clear payment terms, maintain a positive customer relationship, and have a late payment policy in place.

Create a contract with clear payment terms

Creating a contract with clear payment terms is essential when it comes to handling late payments professionally. To ensure clarity and avoid any misunderstandings, include the following in your contract:

- Clearly state the due date for payment.

- Specify the accepted forms of payment.

- Outline any late payment fees or interest charges.

- Include a provision for resolving payment disputes.

- Clearly define what constitutes a breach of contract regarding late payments.

- Specify any consequences or actions that may be taken if payment is not received on time.

Maintain a positive customer relationship

Maintaining a positive customer relationship is crucial when it comes to handling late payments professionally. By fostering open and clear communication with your clients, you can address payment issues in a respectful and effective manner.

Regularly checking in with your customers and providing updates on their outstanding balances will keep the lines of communication open. This approach can help you build trust and understanding, making it easier to navigate any challenges that arise.

Additionally, being proactive in addressing late payments shows your commitment to customer service and can lead to stronger long-term relationships.

Have a late payment policy in place

A late payment policy is essential for effectively handling late payments. It helps establish clear expectations and consequences for clients who fail to pay on time. Here are some key components to include in your late payment policy:

- Clearly outline the payment terms: Specify the due date, accepted forms of payment, and any penalties or fees for late payments.

- Communicate the policy upfront: Include the policy in your client contracts or agreements, so there are no surprises when it comes to payment expectations.

- Send reminders: Implement a system for sending friendly reminders before and after the due date to ensure clients are aware of their outstanding invoices.

- Offer incentives for early payments: Consider providing discounts or rewards for clients who consistently pay on time or ahead of schedule.

- Enforce penalties for late payments: If a client fails to make a timely payment, clearly state the consequences, such as additional fees or interest charges.

- Maintain professional communication: When discussing overdue payments with clients, remain calm and respectful. Clearly explain the situation and emphasize the importance of timely payment.

- Follow up promptly: If a client still hasn’t paid after initial reminders, have a process in place for escalating communications, such as through phone calls or certified letters.

- Consider negotiation options: In certain cases, it may be beneficial to negotiate an alternative payment plan with struggling clients rather than pursuing legal action immediately.

- Utilize debt collection services if necessary: For persistent non-payment issues, partnering with a reputable debt collection agency can help recover outstanding debts while maintaining professionalism.

Strategies for Handling Late Payments

When dealing with late payments, it’s important to start with a polite follow-up to remind clients of their outstanding balance. Be persistent in your communication and consider legal action if necessary.

Utilize online tools to streamline the process and make it easier for both you and your clients. To learn more about these strategies for handling late payments professionally, keep reading!

Start with a polite follow-up

Begin by sending a courteous follow-up to the client regarding their late payment. Politely remind them of the agreed-upon due date and request an update on when you can expect the payment.

Keep the tone professional and friendly, as this can help maintain a positive customer relationship while addressing the issue at hand. By starting with a polite follow-up, you demonstrate your professionalism and open communication, which may encourage prompt action from the client.

Be persistent and don’t give up

If a client has not paid their invoice by the due date, it’s important to be persistent and not give up. Follow up with them politely through phone calls or emails to remind them of the outstanding payment.

Keep records of all your communication with the client regarding the late payment. If necessary, consider escalating the issue by sending a formal demand letter or seeking legal action.

It may take some time and effort, but being persistent can help you collect what is rightfully yours and ensure that your business maintains a professional reputation when it comes to dealing with late payments.

Consider legal action if necessary

If all else fails and you still haven’t received payment despite your efforts, it may be necessary to consider legal action. This step should only be taken as a last resort when all other methods have been exhausted.

Hiring an attorney can help you navigate the legal process and determine the best course of action for recovering what is owed to you. Remember, taking legal action can be time-consuming and costly, so make sure to weigh the potential benefits against the potential drawbacks before proceeding.

Utilize online tools

Online tools can be extremely helpful in managing late payments. Here are some tools you can use to streamline the process:

- Invoicing software: Use online invoicing software to easily create and send professional invoices to your clients. These tools often have features that allow you to set reminders for when payments are due.

- Payment gateways: Consider integrating a payment gateway into your website or invoicing software. This allows clients to make payments online, making the process more convenient for both parties.

- Automatic payment reminders: Take advantage of online tools that automatically send payment reminders to your clients before their due date. This can help prompt them to submit their payment on time.

- Late fee calculators: If you have a late payment policy in place, an online late fee calculator can come in handy. Simply input the necessary information, such as the amount owed and the number of days past due, and it will calculate the appropriate late fee.

- Payment tracking systems: Use online systems that track your incoming and outgoing payments. These tools can provide valuable insights into overdue payments, allowing you to take appropriate action.

An Innovative Funding Solution to Avoid Late Payments

Introducing FundThrough, a game-changing funding solution that can help businesses avoid the negative impact of late payments.

Introduction to FundThrough

FundThrough is an innovative funding solution that can help small businesses avoid the challenges of late payments. With FundThrough, businesses can access their unpaid invoices’ funds upfront, ensuring a steady cash flow and avoiding the stress of waiting for payment.

This allows businesses to focus on important work and promotes faster business growth without the burden of chasing latepaying customers. By utilizing FundThrough, small businesses can effectively manage late payments in a professional manner and maintain positive relationships with their clients.

Benefits of using FundThrough

FundThrough offers several benefits for small businesses dealing with late payments:

- Provides immediate funding: FundThrough allows you to access the funds tied up in your unpaid invoices, giving you instant cash flow to cover expenses and meet financial obligations.

- Eliminates the need for collections: With FundThrough, you don’t have to waste time and resources chasing down late payments. They handle the collections process, freeing up your time to focus on more important aspects of your business.

- Improves cash flow management: By providing quick payment for your outstanding invoices, FundThrough helps you better manage your cash flow and avoid cash shortages that can impact your business operations.

- Reduces stress and increases peace of mind: With FundThrough’s reliable funding solution, you no longer have to worry about late payments affecting your business. You can have peace of mind knowing that you have access to the funds you need when you need them.

- Enhances business growth opportunities: By having a steady cash flow through FundThrough’s funding solution, you can take advantage of growth opportunities such as investing in new equipment or expanding your operations.

- Simple and easy-to-use platform: FundThrough’s online platform makes it easy to manage your invoices and track payment statuses. The user-friendly interface makes the entire process straightforward and efficient.

- Flexible financing options: Whether you have one invoice or multiple outstanding invoices, FundThrough provides flexible financing options tailored to suit the unique needs of your business.

- No long-term contracts or hidden fees: FundThrough operates on a pay-as-you-go basis, without any long-term commitments or hidden fees. This transparency ensures that there are no surprises when it comes to fees or charges.

- Extensive customer support: If you have any questions or need assistance, FundThrough offers dedicated customer support to ensure that you have a seamless experience throughout the funding process.

Alternatives for handling late payments

There are several alternatives for handling late payments professionally:

- Offer flexible payment options: Provide customers with the option to pay in installments or set up a payment plan to ease their financial burden.

- Implement late fees: Include a clause in your contract that specifies a penalty for late payments. This can help incentivize clients to pay on time.

- Use invoice financing: Consider utilizing invoice financing services like FundThrough, which allows you to get paid for your outstanding invoices immediately, helping you maintain cash flow.

- Set up automated reminders: Utilize software or tools that automatically send reminders to clients about upcoming due dates, reducing the likelihood of late payments.

- Offer incentives for early payment: Encourage prompt payment by offering discounts or rewards to clients who pay before the due date.

- Seek professional help: If dealing with persistent late payments becomes overwhelming, consider hiring a collections agency or working with a lawyer experienced in debt recovery.

Conclusion

In conclusion, effectively handling late payments is crucial for small businesses. By establishing clear payment terms, maintaining positive customer relationships, and having a late payment policy in place, you can minimize the impact of late payments on your business.

Additionally, utilizing polite follow-ups, persistence, and legal action if necessary will help you collect outstanding payments professionally. Consider using innovative funding solutions like FundThrough to avoid future late payment issues and ensure smooth cash flow for your business.